As we usher in 2024, a world of exciting opportunities awaits in the U.S. real estate market, particularly for foreign nationals and U.S. expats seeking to make strategic investments.

What to Expect in 2024

Zillow.com predicts the prices of homes in the United States will increase by 6.5% from July 2023 to July 2024. This increase is based on rates remaining relatively unchanged. The prediction suggests that the value of homes is likely to increase, mainly due to the lack of inventory and owner-occupied buyers waiting for interest rates to decrease. What will happen to property prices if interest rates decrease?

The housing market is constantly changing, subtly shifting over time. For those investors with a keen eye, there’s an opportunity to discover a unique and profitable niche. The current state of real estate, marked by a standoff between buyers and sellers due to high mortgage rates, creates an environment where savvy investors can make strategic moves. Suzanne Miller from Empire State Properties notes that despite the rising home prices, many potential buyers are holding back due to these higher mortgage rates.

In line with Bank of America’s 2023 Homebuyer Insights Report, this shift in the market is already underway. In line with Bank of America’s 2023 Homebuyer Insights Report, this shift in the market is already underway. In October, nearly 40% of those looking to purchase homes expressed their determination to proceed with house hunting, showing little regard for waiting until conditions improve. This contrasts sharply with the sentiment observed just six months prior, where only 15% of potential homebuyers demonstrated a similar eagerness to move forward.

Renowned real estate expert Barbara Corcoran anticipates a significant market shift when interest rates drop. “The minute those interest rates come down, all hell’s going to break loose, and the prices are going to go through the roof,” she said. “Right now, sellers are staying put. But they’re not going to stay put if interest rates go down by two points.

“It’s going to be a signal for everybody to come back out and buy like crazy, and the house prices [will likely] go up by 20%,” she said. “We could have COVID [market] all over again.”

Advantage for International Investors

International investors have a clear advantage. The National Association of Realtors reports a 9.6% decline in annual foreign investment in U.S. existing home sales, totaling $53.3 billion. This decline, along with the lack of owner-occupied buyers sitting on the sidelines, means less competition, making it an excellent time to get into the U.S. real estate landscape.

Rental Opportunities

Understanding the opportunities for profitable investments, overseas investors should consider exploring rental options and the potential returns they offer. As home prices rise and available properties become scarce, there are numerous possibilities for U.S. investment properties with high potential returns.

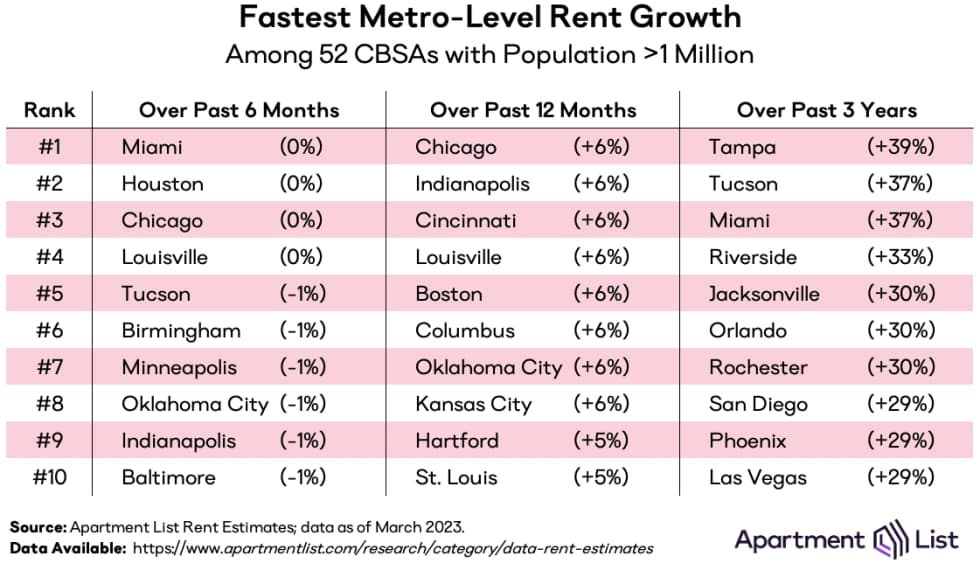

The latest report from ApartmentLists highlights cities that have experienced the most significant growth in the past 12 months. Leading the list are Indianapolis (+6%), Columbus, OH (+6%), Oklahoma City (+6%), Hartford (+5%), Chicago (+6%), and Cincinnati (+6%). Since the start of the pandemic, Tucson, AZ, has seen a substantial 37% increase in rents, while Tampa, Florida, has also seen significant rent growth, up by 39%.

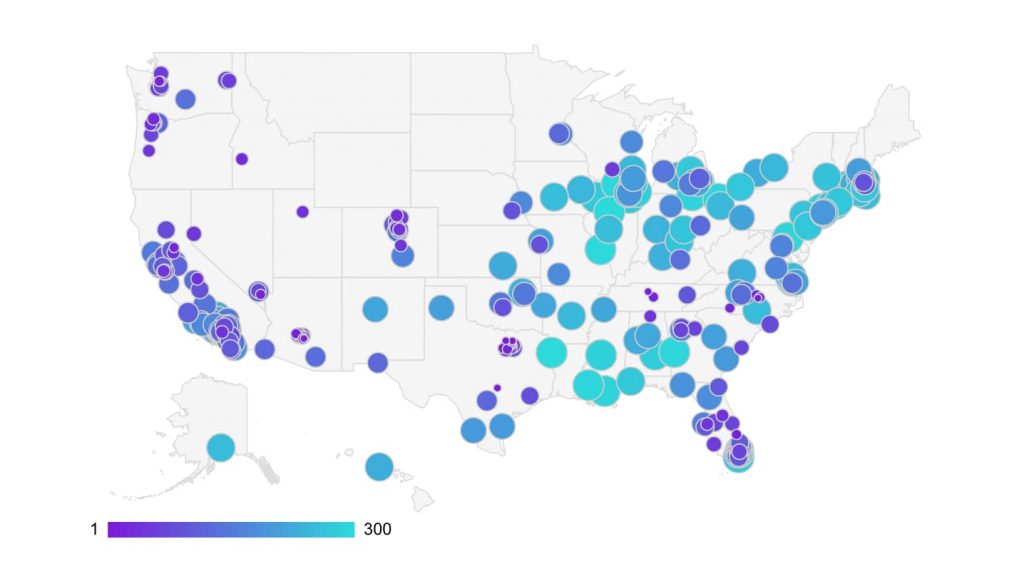

Wallethub also compiled a comprehensive list of cities with thriving real estate markets and high buyer demand:

Seize the Opportunities with America Mortgages

As we navigate 2024, whether you’re a seasoned investor or just entering the world of real estate, now is the time to act. Our team is ready to guide you through your journey, ensuring that you not only invest but thrive in the ever-evolving real estate landscape.

As a company, America Mortgages’ only focus is providing U.S. mortgage financing for foreign nationals, non-residents, and U.S. expats. 100% of our clients fit that profile, and no one does it better.

Reach out to us now to schedule a commitment-free consultation with one of our U.S. mortgage loan officers based worldwide; simply use this 24/7 calendar link to book an appointment.