In the tech world, you will hear terms like “platform” and why they are so valued by investors. These are the Amazons and Facebooks of the world and it’s because once they cover their fixed costs, as their revenue grows, so does their profitability. It’s also called operating leverage.

In a way, so is owning an investment property with a 30-year fixed-rate mortgage. Your fixed costs are flat for 30 years (and if rates fall, you can refinance to a lower rate), but rental income and property values increase over time.

Rental prices, in particular, have been rising considerably, especially during the last 12 months, despite a rise in interest rates given the lack of property supply and also the marginal buyer who cannot own at 7% mortgage rates is forced to rent.

In a perverse way, the rate increases have made it a better environment to own an investment property, especially in states like Texas and Florida, where families prefer to migrate to, given low state taxes and affordable cost of living.

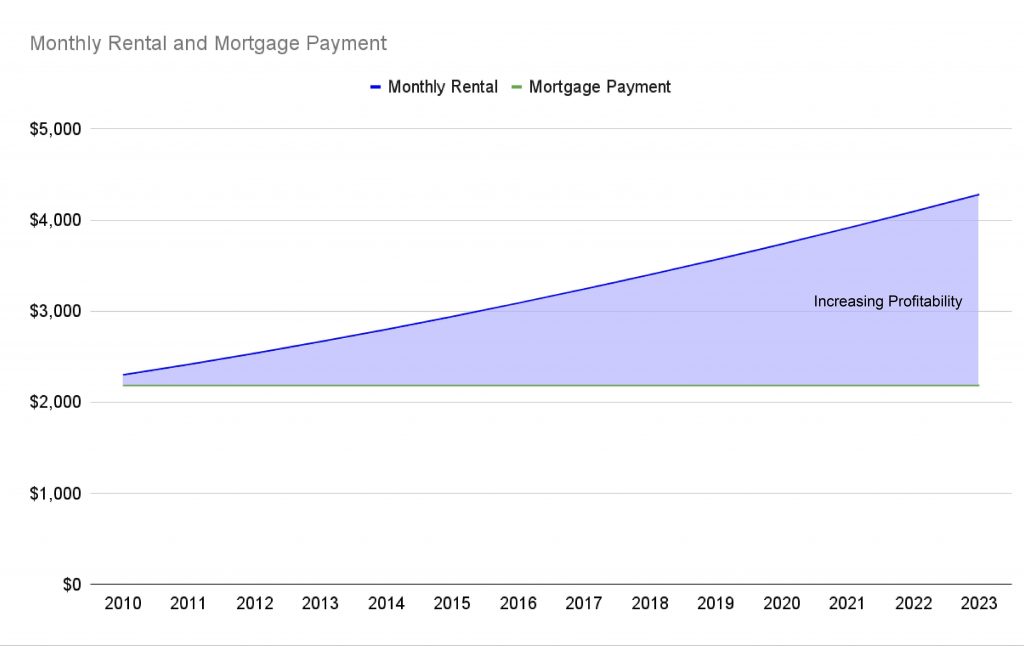

Here is a visual to explain this important point:

Amy, a savvy homebuyer living in Hong Kong, purchased her dream investment home in Los Angeles back in 2010. Recognising the benefits of a 30-year fixed-rate mortgage, she secured a loan at an interest rate of 5.25%. This meant that her monthly mortgage payment would be approximately $2,185.

- Home price in 2010: $500,000

- Rental price in 2010: $2,300/month

- Monthly mortgage payment in 2010: $2,185/month

- Home price in 2023: $2,000,000

- Rental price in 2023: $4,500/month

- Monthly mortgage payment in 2023: $2,185/month

As you can see, Amy’s monthly mortgage payments have remained the same over the years, while rental prices have steadily increased. This has resulted in a significant financial advantage for Amy.

Only in the U.S.!

The United States is the only country in the world that offers homeowners a 30-year fixed-rate mortgage, which provides stability and predictability. This means that your monthly mortgage payments will remain the same for the entire loan term, even if interest rates fluctuate. This can be a huge advantage, as it gives you peace of mind and financial security. When interest rates do go down in the future, you can refinance your mortgage and take advantage of the lower rate. This could save you a significant amount of money over the life of your loan.

What are 30-Year Fixed Interest Rates?

A 30-year fixed interest rate is a mortgage loan with an interest rate that remains constant throughout the loan’s entire term, typically three decades. This stability and predictability make it an attractive option for many homebuyers.

Advantages of 30-Year Fixed Rates:

- Predictable Payments: Homebuyers benefit from knowing their mortgage payments will remain consistent over the long term. This predictability allows for better financial planning and budgeting.

- Long-Term Stability: A 30-year fixed-rate mortgage offers homeowners extended stability. In uncertain economic times, this type of mortgage shields borrowers from sudden fluctuations in interest rates.

- Protection from Market Volatility: Homebuyers can take advantage of historically low-interest rates when they lock in their mortgage for 30 years, safeguarding themselves from potential future rate hikes.

Key Takeaways

- Foreign nationals can purchase homes in the United States, but they may face additional challenges, such as obtaining a mortgage.

- A 30-year fixed-rate mortgage can provide stability and predictability for foreign nationals who are buying homes in the United States.

- The cost of renting can increase over time, while the cost of a mortgage payment can remain the same.

Amy’s case study shows that a 30-year fixed-rate mortgage can be a wise financial decision for foreign nationals who are buying homes in the United States. By locking in a fixed interest rate, Amy was able to protect herself from market volatility and ensure that her monthly mortgage payments would remain the same for 30 years. This gave her peace of mind and financial security, even as rental prices in her area increased.

America Mortgage is a leading mortgage lender that specialises in working with foreign nationals and U.S. expats. We have a team of experienced loan officers who can help you navigate the mortgage process and find the best loan for your individual needs.

If you are a foreign national considering buying a home in the United States, we encourage you to contact America Mortgage. We would be happy to help you find the best mortgage for your individual needs. Get in touch with us at [email protected] to find out more.