1. Wish I Could Time the U.S. Real Estate Market

“The market can stay irrational longer than you can stay solvent. That’s why it’s important to have a long-term investment horizon when you’re investing in real estate. Don’t try to time the market. Just focus on finding good deals and investing in properties that you believe in.” – John Maynard Keynes, Economist

The U.S. real estate market is an ever-changing landscape, but there has been far more success stories than not. However, understanding the factors that affect the market, such as interest rates, can increase your chances of making a wise investment in a timely manner.

For example, when interest rates are high, it’s an excellent time to buy since the marginal buyer can not afford the mortgage at current levels. This creates less demand and gives you pricing power over sellers to negotiate a better purchase price.

Conversely, when interest rates are low, it’s a great time to sell, as financing becomes more affordable and potential buyers emerge, creating more demand and giving more pricing power to sellers to negotiate higher selling prices.

Most sophisticated investors jump into this type of market immediately as property values will remain stable, and the opportunity to get not just a good deal but a great deal is much more possible. Remember, “Date the rate. Marry the property.” Interest rates will go up, and interest rates will go down. The unique aspect of U.S. real estate investing is that the U.S. allows you to fix an interest rate for 30 years regardless of the borrower’s age. If rates go down, refinance to a lower rate. If rates keep increasing, then you have the confidence of knowing that your mortgage payment is fixed. However, the likelihood of rental rates increasing is almost certain.

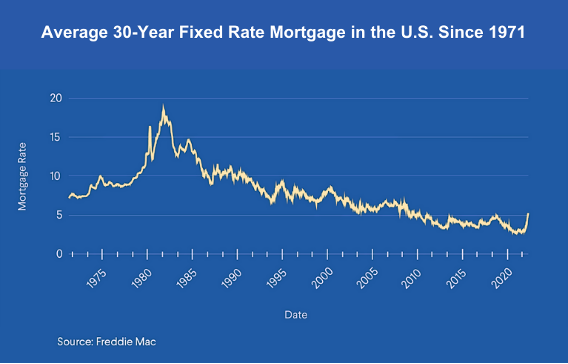

If you think interest rates are high, here’s a look at historical interest rates in the U.S.:

As you can see, interest rates have been trending downward for many years. This is good news for potential buyers because it means that monthly mortgage payments will be lower.

Bottom Line: The time you spend in the market is more important than timing the market.

2. I Wish Interest Rates Were Lower

Even though interest rates are higher now than they were a few years ago, they are still historically low. In fact, the average interest rate on a 30-year fixed-rate mortgage is currently around 7.50%. This is still much lower than the average interest rate of 14.6% in 1980.

So, why do investors still invest in U.S. real estate when interest rates are high? There are a few reasons:

Real estate is a tangible asset – Unlike stocks or bonds, real estate is a physical asset that you can touch and see. This makes it a more attractive investment for some people.

Real estate is a long-term investment – If you buy and hold onto a property long-term, you’ll likely see your investment appreciate in value.

Real estate can generate income – If you rent out your property, you can generate income to help offset your mortgage payments. With 30-year fixed rates (regardless of age), investors have the confidence of knowing their expenses are fixed, while rental rates increase over time.

3. I Wish Property Values Doubled Every Year

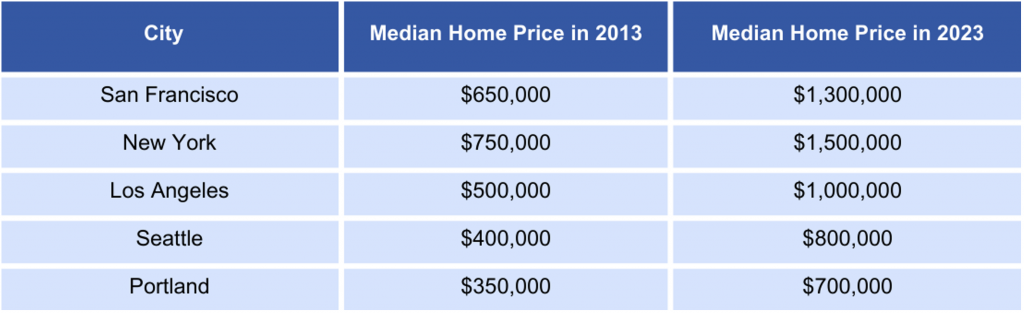

It would be great if property values doubled yearly, but unfortunately, that’s unrealistic. However, in some areas, property values appreciate more quickly than in others. For example, in hot real estate markets like San Francisco and New York City, property values can double in as little as 10 years.

In stable, consistent real estate markets such as the U.S., property values generally appreciate at an average rate of 3%-5% per year. However, several factors can affect the rate of property appreciation, such as the overall health of the economy, the supply and demand for housing in a particular area, and interest rates.

We at America Mortgages are here to help foreign nationals and U.S. expat investors navigate the intricacies of U.S. real estate investing. Our expertise and tailored mortgage options can help you achieve your investment goals and make the most of the opportunities in the market.

Our team of experienced loan officers is well-versed in working with foreign national and expat clients. We can help you navigate the complexities of U.S. mortgage options, ensuring that you have access to the most suitable financing solutions for your specific circumstances. Whether you’re looking to diversify your investment portfolio, purchase a home, or establish a foothold in the U.S. real estate market, America Mortgages is your trusted partner.

Contact us today at [email protected] to explore how we can assist you in achieving your U.S. real estate investment dreams. With our expertise and personalised approach, we are here to help you seize the opportunities and build a successful real estate portfolio in the U.S.