Some investors won’t move forward on a deal if the cap rate is too low. In some cases, they can’t even calculate a cap rate because there’s no income yet. A good example of that is buying vacant land for a future development.

Personally, I prefer to invest in deals where the IRR, or Internal Rate of Return, shows a potential return of at least 20% on an all-cash basis. If it’s a development project, I’m aiming for 30%. Even though I usually use financing, I always start with the all-cash IRR. It’s a reality check.

It’s really easy to get pulled into a deal just because the IRR looks great when financing is included. But the risk can be much higher than it seems, and if things don’t go as planned, you could end up dealing with a foreclosure.

So here’s how I approach it. If the all-cash IRR looks solid, I’ll then run a second IRR analysis using financing. That version will naturally show a higher return, but I already know the deal works without needing debt to make it pencil out.

Now you might be thinking: how is a strong IRR possible if the cap rate is super low, or even zero, on day one?

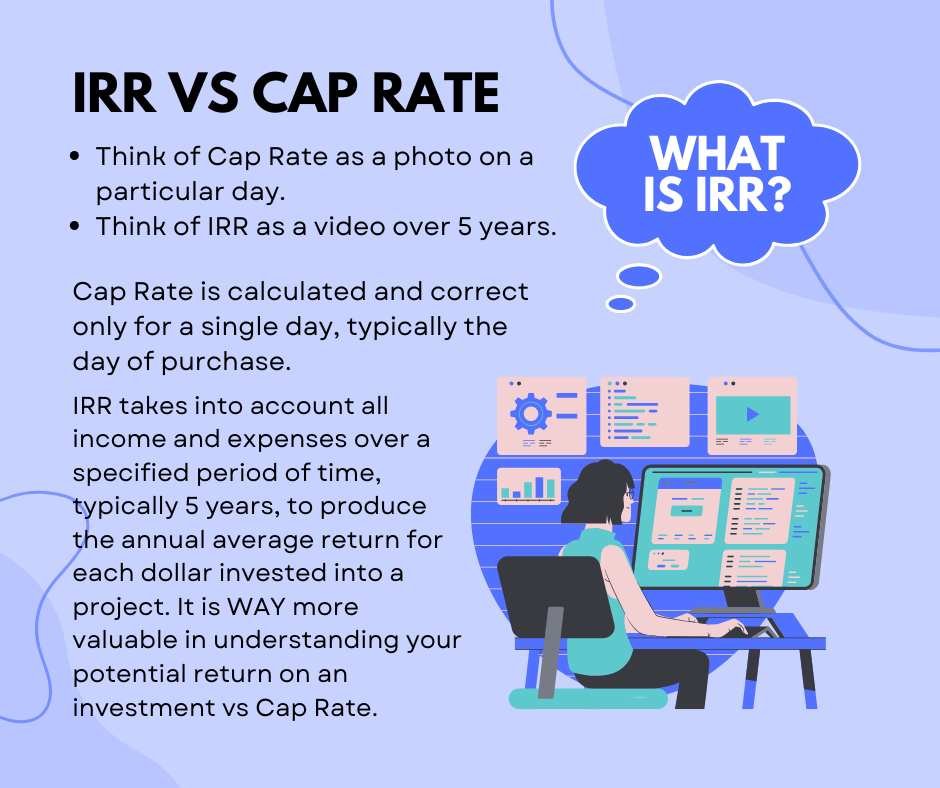

Here’s the thing. Cap rate is just a snapshot of the property’s income at the time you buy it. It can’t see into the future. It doesn’t know what you plan to do with the property. Think of it like a still photo taken on closing day.

IRR, on the other hand, is like a video. It starts the day you close and continues through the full hold period, typically five years. It sees everything you’re planning to do.

For example, maybe you’re buying an apartment building that’s only 50% occupied. The IRR sees your renovation plan. It sees you increasing rents by 25% once the upgrades are done. It sees your improved management pushing occupancy to 95% within a year. And it sees continued rent growth year after year.

Eventually, the video gets to the point where you sell the property, now in excellent condition and in a highly desirable location—say, near the beach in California. Thanks to all the improvements, you’re able to sell at a strong price with a final cap rate of 5%. That’s why the IRR looks attractive, even though the cap rate at purchase didn’t.

Another thing to remember is that an IRR calculation always includes an exit event to complete the picture, even if you’re not planning to sell. A lot of investors refinance instead, pull some equity out, and roll it into the next deal.

So next time you’re evaluating a commercial property, don’t get discouraged if the cap rate looks weak. Focus on your business plan. Understand the upside. And work with someone who can help you run the IRR numbers correctly.

By the way, we love working with foreign nationals investing in U.S. commercial real estate. Not only can we help with financing, we’re active investors and developers ourselves.

Contact me today and let’s talk about your next deal.

Lance Langenhoven

Head of Commercial Lending