Welcome to our newly revamped weekly product, where we do a quick summary of salient news over the past week and what to expect the following week and beyond. It took a while to think of a catchy name for our weekly and we hope you like it. We also plan to include our house view of the major macro events and, of course, how it all relates to the global real estate markets, in particular the US.

Contents:

- Ex-post; Ex-ante

- Will rates decline? Yes, starting in March!

- Why US home prices will not collapse

- Buyer’s Guide to California

- Loans of the week!

Ex-post

Last week saw major headlines with UK printing a 10% inflation number and Europe continuing to see hefty price increases in energy costs, with Germany at €700 ($696) a megawatt-hour, up from under €50 in January.

In the US, mortgage applications dipped slightly for the week ending August 12, 2022, down 2.3% week on week. Things are generally slower in all areas of the economy in August, and this is no different.

30-year fixed rate 5.45% mortgages are down 50 bps from June 2020 highs of 5.98%

* This reference rate is for conforming Fannie Mae loans, not applicable for overseas borrowers.

Ex-ante

This week, all eyes will be on Jackson Hole, where Fed chair Jerome Powell will speak on the economic outlook at 10 am Washington time. We cannot see Powell becoming incrementally dovish at this stage, while there could be an outside chance of being less hawkish. As a firm, our house view is that given the fact that the “reputation and credibility as an institution” is under pressure, the Fed will risk over-tightening in this economic cycle – right or wrong. To us, tightening into a recession is extremely heavy-handed, but Powell certainly does not want to be remembered as Arthur Burns 2.0.

The Trillion-dollar question is IF rates will be cut, and if so, how much?

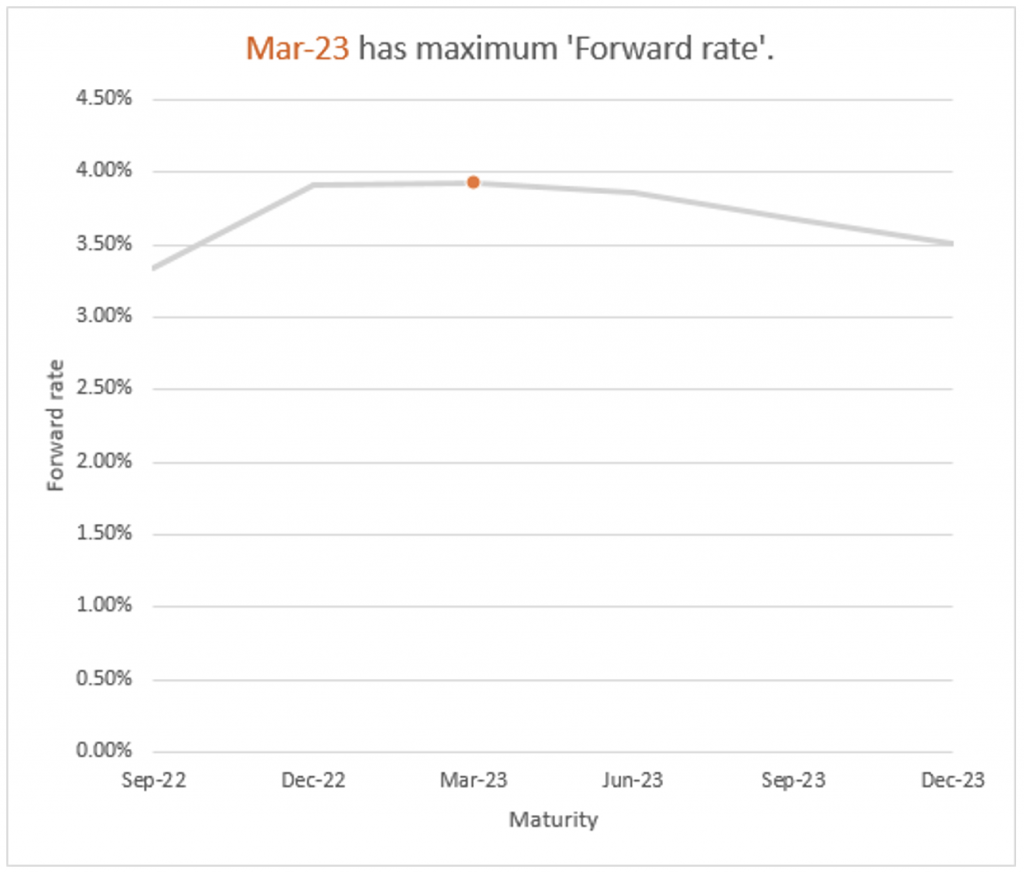

If you look at the Eurodollar implied futures curve, you will see that the market is expecting rates to peak in March 2023 at 3.93% and then start to decline to 3.51% by December 2023, and drop to 3.03% a year later. That is to say; the market is expecting 90 bps of decline in Fed Funds by December 2024! The charts also imply that rates are expected to stay under 3% thereafter.

3-month Eurodollar Futures Yield Curve

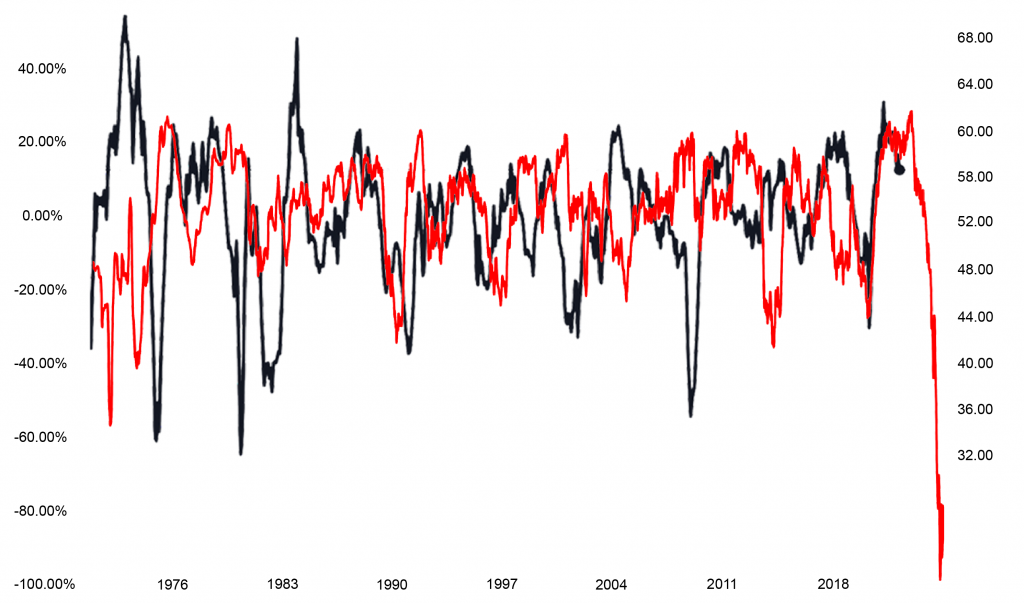

ISM Manufacturing Index – US 30-Year Mortgage, YoY%, 18-Month Lead Inverse”

One area of potential concern is US industrial production, which is at risk of significant contraction (below 50 on ISM Manufacturing Index is a contraction). If so, this could trigger deeper recession concerns. The next the Institute of Supply Management (ISM) report will be out September 1st.

If you look at this chart, it appears that the ISM Manufacturing Index (black line) lags the inverse of the US average 30-year mortgage rates (red line) by about 18 months. If the US manufacturing economy pans out in this manner, the Fed may be forced to make deeper cuts and we could see a bigger decline in rates than the market is pricing in, giving another opportunity for US home buyers who are waiting for lower rates!

Home Prices

There is no impending collapse. We see strength in housing prices.

As we read in the media that home prices are softening, housing starts declining, home prices are falling, and it paints a doom and gloom picture, but we cannot see a collapse in housing prices and a repeat of 2008.

Did you know that 40% of all homes in the US are held free and clear without a mortgage?

The average outstanding mortgage is 33% of home values. There is simply too much equity in the market for a collapse. Since 2008 underwriting standards have been significantly more stringent with more regulatory oversight. More importantly, most of the outstanding mortgages were printed when rates were below 4%!

Sure, in some cities, there will be softening as residents gentrify out to lower cost of living areas. It’s no surprise that San Francisco, Los Angeles, and New York City are at the tops of those cities where there are significant outflows of residents.

According to a Redfin article on July 18, 2022, here are the:

Top outflow cities in 2Q2022:

| San Francisco | 48,718 | Top destination: Sacramento |

| Los Angeles | 40,632 | Top destination: San Diego |

| New York City | 48,731 | Top destination: Philadelphia |

Top inflow cities in 2Q2022:

| Miami | 12,614 | Top origin city: New York City |

| Tampa | 7,939 | Top origin city: Orlando |

| Phoenix | 11,464 | Top origin city: Los Angeles |

Buyer’s Guide to California

Over the past 2 weeks, we have published a Deep Dive into what drives overseas buyers to California. In Part 1 – Education. We look at the top 50 public and private high schools in the state, average SAT/ACT scores, Median Income and Average Home prices and conclude the cities with the top schools tend to have the strongest property price appreciation and rental reversions.

In last week’s Part 2 – Demographics. We look at the Asian population in each of these schools and conclude the schools with the highest Asian population is another driver of home prices where the top schools are located.

This week, in Part 3 – Taxes and Benefits. We will conclude the report with a tax guide for overseas investors, how rental income is taxed and various deductions that are allowed.

Finally, to wrap-up our Buyer’s Guide to California, we will be hosting a webinar with Susan Kim, our Private Client US Concierge Partner and top real estate experts in San Francisco, Palo Alto, Los Angeles, and Orange County to give you an on-the-ground discussion on the respective cities, where the value is now and in the future. Stay tuned!

Loans of the week!

1. Switzerland Family Office purchases luxury condo in New York

Client wanted options outside of their private bank which did not require pledging assets.

Type: Luxury Condo

Price: $20M

Loan Amount: $11M (55% LTV)

Use: Second home

Loan type: America Mortgage HNW+

Qualification: Using borrower’s liquid investment portfolio as a reference without encumbrances. (Example Fidelity account)

Term: 5-year fixed / 30-year amortized

Interest-only: Fixed for 5 years

Rate: 7.875%

2. UK technology entrepreneur purchases home in Atherton (near Palo Alto)

UK-national client attended Stanford and plans to move their children there in 3 years to attend high school. His goal was to rent out the home to tech executives or AirBNB in the interim.

Type: Single-family home

Price: $10.9M

Loan Amount: $6M (55% LTV)

Use: Investment

Loan type: America Mortgage HNW+

Qualification: Using borrower’s liquid investment portfolio as a reference without encumbrances. (Example Fidelity account)

Term: 5-year fixed / 30-year amortized

Interest-only: Fixed for 5 years

Rate: 7.25%

3. Singaporean family purchases home in San Antonio for rental income

Father attended the University of Texas and, after reading our Deep Dive report, decided to own a home where he could take advantage of the strong USD and rental income currently in San Antonio and potentially will move there for retirement.

Type: Single-family home

Price: $350,000

Loan Amount: $245,000 (70% LTV)

Use: Investment

Loan type: America Mortgage Foreign National+

Qualification: Based on overseas income and credit

Term: 30-year fixed

Rate: 6.875%

Thank you and feel free to contact us if you have any questions.