Cities across the U.S. have seen some of the highest rental yields to date. From 2020 to 2021, home sales prices rose approximately 20%. That’s great news for real estate investors that held property pre-pandemic, but with low inventory and rising rates forcing the owner-occupied borrowers out of the market, opportunities for high-yield U.S. investment properties are abundant. Here are the top 10 U.S. cities with the highest rental prices and most affordable properties.

1. Houston, Texas

The lack of affordable single-family homes has created a demand for rental properties in Houston. Its strong job market makes it a solid play for investors of these types of properties.

Average Purchase Price: $496,930

Average price/sqft: $155

Average Rental Income: $3,455

2. Arlington, Texas

Arlington, a city in north Texas, is ranked 12 on the list of the top places in Texas to purchase a home, according to Policygenius. At $275,745, the average house value is 6% more than the national average, and its five-year growth rate is 63.6%.

Average Purchase Price: $493,700

Average price/sqft: $174

Average Rental Income: $3,035

3. Tampa, Florida

Investors were responsible for purchasing 25% of homes sold in Tampa in the summer of 2021. Average rents have had the highest spike in the country, and impressive job growth in white-color professions shows no signs of slowing.

Average Purchase Price: $508,725

Average price/sqft: $252.65

Average Rental Income: $3,004

4. San Antonio, Texas

San Antonio could be an excellent investment. The city boasts affordable property prices and excellent average rental yields per month. In 2020, approximately 40% of individuals looking to rent were out-of-city transplants, which has mostly stayed the same.

Average Purchase Price: $514,975

Average price/sqft: $170.53

Average Rental Income: $2,951

5. Charlotte, North Carolina

Charlotte, North Carolina’s robust employment market, four-season climate, and proximity to the beach and mountains make it a top destination for real estate investors looking to earn rental income.

Average Purchase Price: $498,750

Average price/sqft: $173

Average Rental Income: $2,796

6. Colorado Springs, Colorado

Colorado Springs is known to be one of the most substantial long-term real estate investments in the U.S. Since the last decade, Colorado Springs’ typical property prices have increased by around 143.7% based on Zillow’s Home Value Index.

Average Purchase Price: $487,475

Average price/sqft: $198

Average Rental Income: $2,770

7. Orlando, Florida

Home to Disney World, Universal, and a fantastic climate, 60 million people visit Orland every year. Some of the best beaches are a drive away, and the city is famous for its gold courses, nightlife, and shopping malls.

Average Purchase Price: $482,085

Average price/sqft: $235

Average Rental Income: $2,739

8. Cincinnati, Ohio

Cincinnati has long been regarded as an affordable city in general. In fact, Cincinnati was ranked as the 14th most affordable U.S. city to live in by U.S. News & World Reports in 2017. In addition to the generally low cost of living, Cincinnati real estate is more affordable than in many other major metropolitan areas. Cincinnati has become one of the go-to markets for out-of-state real estate investors looking to buy properties at a good price and still earn a reasonable rate of return, and prices have increased as a result.

Average Purchase Price: $474,750

Average price/sqft: $171

Average Rental Income: $2,734

9. Jacksonville, Florida

Jacksonville benefited from Florida’s decision to loosen pandemic restrictions more quickly than other states. The city has one of the highest-performing economies in the country and a dwindling unemployment rate.

Average Purchase Price: $501,850

Average price/sqft: $187

Average Rental Income: $2,564

10. Huntsville, Alabama

Listed as one of the top cities to purchase a rental property for cash flow in 2022, Huntsville is known for its rent growth value. Strong employment growth and low housing costs have led to equity growth of about 24%, 22% more than the national average.

Average Purchase Price: $487,250

Average price/sqft: $171

Average Rental Income: $2,436

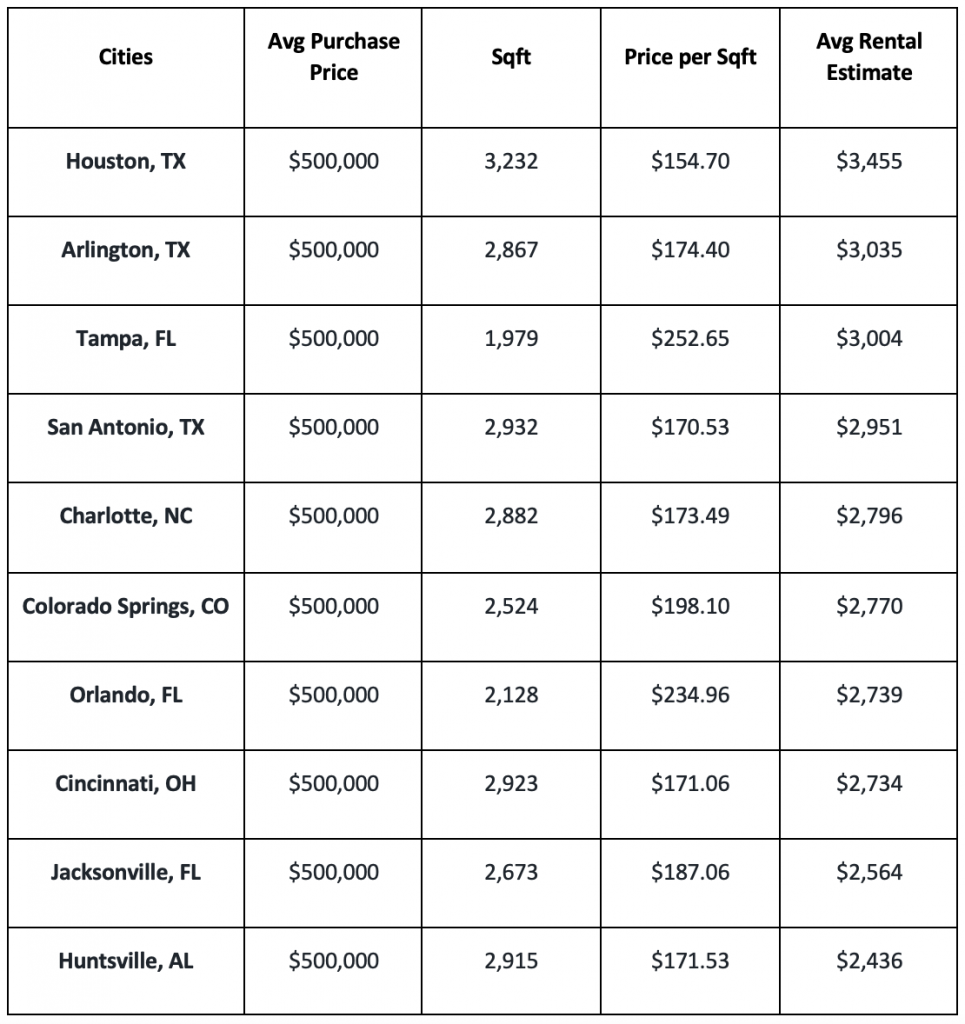

If we assume the purchase price of each city’s house to be $500,000, here’s the rank based on the highest rental income:

With creative loan options offering fixed terms for interest-only loans, buying down of interest rates, and long-term capital appreciation, investing in U.S. cities with the highest rental income gives you significant short-term and long-term possibilities.

Ready to reap the benefits of investing in the U.S.?

As a company, America Mortgages’ only focus is providing U.S. mortgage financing for U.S. expats and foreign nationals. We know exactly what is required to ensure that your mortgage journey is stress-free. We qualify 97% of our client’s for a U.S. mortgage. What are you waiting for? Schedule a call with our U.S. mortgage specialist to find out your mortgage options. [email protected]