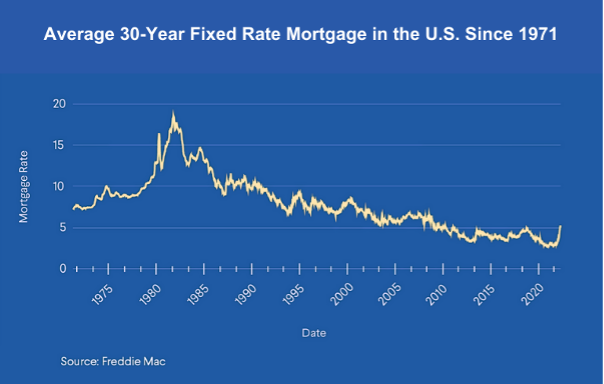

Everyone is aware mortgage interest rates have been rising since early last year. The average interest rate on a 30-year mortgage is now almost 7%.

Those rates have undoubtedly made buying a home more expensive. In fact, according to the Mortgage Bankers Association, the median mortgage payment is now $2,162 — up 14% from a year ago, making it difficult for many homebuyers to afford; hence, they are forced to rent, creating a perfect storm for rental property owners.

Sophisticated investors rejoice as it is now a BUYER’S MARKET. If you take the popular “marry the property, date the rate” approach, experts say those higher rates might not seem all that bad.

What exactly does this approach entail, though? Here’s what you need to know.

What does “marry the property, date the rate” mean?

“Marry the property, date the rate” is a popular saying these days, thanks to higher interest rates. Essentially, the idea is that when you buy a house in today’s market, you focus on finding the perfect investment property or second home — a home you love and want to tie yourself to for the long term (like a marriage).

But your rate? That’s something you approach as only temporary — someone you’d date but never really commit to.

“This strategy suggests that you should prioritise finding the right property that checks all the boxes for your long-term needs and preferences rather than getting overly fixated on the current interest rates,” says Nick Worthing, America Mortgages’ Vice President of U.S. Lending. “In other words, focus on the specifics of the property itself, as it’s a long-term investment, while considering interest rates as a variable that can change over time.” He further states, “Sophisticated investors jump into the market when they are in the driver’s seat and can negotiate great deals. The novice investor jumps into the market when everyone else does. It doesn’t mean one investment strategy is right and the other is wrong; it simply means an – opportunity.”

The key component of the “marry the property, date the rate” approach is refinancing and potentially taking advantage of increasing property values once rates decrease again (and if history repeats itself, they will). If you choose this strategy, you’d take today’s interest rates as a necessary evil and then plan a refinance down the road — once rates fall and you’re done “dating” that initial rate.

When is it smart to “marry the property, date the rate”?

Taking the “marry the property, date the rate” approach can be a smart strategy as long as you follow two simple rules: First, make sure your mortgage payment is one you can comfortably afford for the foreseeable future and the rental amount is sufficient to cover all or most of that amount. There’s always the chance that rates won’t drop soon, so make sure you aren’t overextending yourself. “If you find the right property at a good price, then it is always the right time to buy with a long-term hold philosophy. In a Buyer’s Market, when the owner-occupied buyer is sitting on the side-lines, the investor has the upper hand to get into a property deal at terms that haven’t been seen for the past few years.

Second, the seller will be willing to “make a deal,” and you need to get the property at a good price. This will not only help offset the cost of those higher rates, but it’s also the one variable you can’t go back on. The strategy here; you have the option to renegotiate your mortgage rate if rates fall, but you can’t renegotiate the purchase price.

When shouldn’t you “marry the house, date the rate”?

Dating the rate isn’t a good idea if you’re in a particularly hot housing market. This likely means you’ll pay an inflated price for your home and compete against people buying their “dream home” to live in. This is not an investors’ market unless you’re looking for a quick flip. If you don’t plan to hold the property for a while, this strategy may not work for you. While refinancing can help you take advantage of lower rates later on, it does come with costs. When interest rates decrease, America Mortgages can easily give you a breakdown to see if/when refinancing makes sense.

Other ways to deal with higher mortgage rates

Rolling over for today’s high mortgage rates isn’t your only option if you want to buy a home in today’s market. For one, you can explore alternative mortgage products that America Mortgages offers. While rates on 30-year loans might be near 7%, there are numerous ways to offset the rate with creative loan programs.

- Interest Only – service the interest at a fixed rate for 10 years. You will not be paying down the principal, but for savvy investors, this is an excellent way to maintain a positive yield.

- 40-year mortgage loans – yes, you read that correctly. America Mortgages now has fixed rate 40-year tenure. This is an excellent way to fix your rate over the long haul. You know exactly what that payment will be for the next 40 years; as rental prices increase, your payment will stay the same. Even if you don’t refinance, this is a fantastic way to see passive income with a long-term hold strategy.

The monthly payment for a amortization 30-year fixed mortgage (P/I) with a loan amount of $250,000 at an interest rate of 5.00% is $1,380. The monthly payment for a 40-year fixed, 10 year interest-only mortgage with the same loan amount of $250,000 at an interest rate of 7.5% is only $1,526. This is an increase of $146, a 10.5% increase.

When compared to the rising cost of rent, the increase in monthly mortgage payments is relatively minimal. The average rent for a two-bedroom apartment in a major U.S. city has increased by more than 40% in the past two years. This means creative financing even in a higher interest rate environment can actual improve rental yield overall.

Will mortgage rates go down soon?

There’s no way to tell for sure if mortgage rates will drop, but if history repeats itself, expect rates to be lower within the next 12 to 24 months. Fannie Mae, the National Association of Realtors, and the Mortgage Bankers Association (MBA) agree, too. MBA predicts the average rate on 30-year mortgages will fall below 5% (owner occupied) by the end of 2024, while Fannie Mae’s projection is a 5.9% average. NAR predicts a slightly higher 6% rate.

It all will depend on inflation and the Fed’s actions in response to it. If inflation stays high and the Fed continues to increase its benchmark rate, mortgage rates could increase even further. If inflation cools and the Fed stops its rate hikes or reduces its rate altogether, mortgage rates could fall. We expect the latter, especially going into the next Presidential election.

The bottom line

For now, mortgage rates are still higher than they were, but still historically low over a 20-year period.

While the “marry the property, date the rate” approach will work for some investors, it’s not the right move for everyone. Always talk to your America Mortgages professional or financial advisor if you’re unsure what is best for your finances. If you do opt for the “date the rate” strategy, make sure you view it with a long-term hold (5 years+). Though refinancing may be an option later on, there’s no guarantee rates will drop while you own the property.

Trust the experts

Unlike most banks and brokers that see one International Investor looking to obtain a mortgage a year, 100% of our clients are International Investors. Trust the experts in this industry to understand the complexities of Foreign National or U.S. Expat clients. For some, this is a rarity. For us, this is all we do! If you’d like information on loan programs or to schedule a call with one of our mortgage professionals, please use this convenient 24/7 calendar link.