Investing in U.S. real estate offers exciting opportunities for foreign nationals and U.S. expats, but structuring these investments correctly is key to protecting the asset and yourself. One effective approach is forming a Limited Liability Company (LLC), which provides benefits like liability protection and tax flexibility. In this week’s America Mortgages Concierge Series, we explore how an LLC can make U.S. property ownership more secure and strategic.

Why an LLC for U.S. Property?

- Asset Protection: An LLC limits personal liability, separating property-related risks from individual assets. In the event of a lawsuit or financial claim, this separation helps protect your personal wealth.

- Tax Efficiency: LLCs offer flexibility in tax structure, allowing investors to maximize deductions associated with real estate investments and choose how profits are taxed. This can lead to significant tax savings.

- Streamlined Estate Planning: Holding real estate in an LLC can make passing property to heirs smoother, often avoiding the probate process. This means less time, lower costs, and an easier transition for your loved ones.

- Privacy: By holding property in an LLC, ownership is listed under the company rather than your personal name, providing an extra layer of privacy that’s particularly appealing for high-net-worth investors.

America Mortgages’ LLC Concierge Service in Partnership with Nobility Consulting

At America Mortgages, our concierge service includes seamless LLC formation support in collaboration with Nobility Consulting. Here’s how our concierge service makes LLC formation hassle-free:

- Expert Guidance: Our partners at Nobility Consulting are well-versed in U.S. LLC requirements, especially for foreign investors, ensuring compliance with local laws and regulations.

- Efficient Filing and Setup: Nobility Consulting assists with state registration and other essential steps, making LLC formation straightforward and accessible for foreign investors.

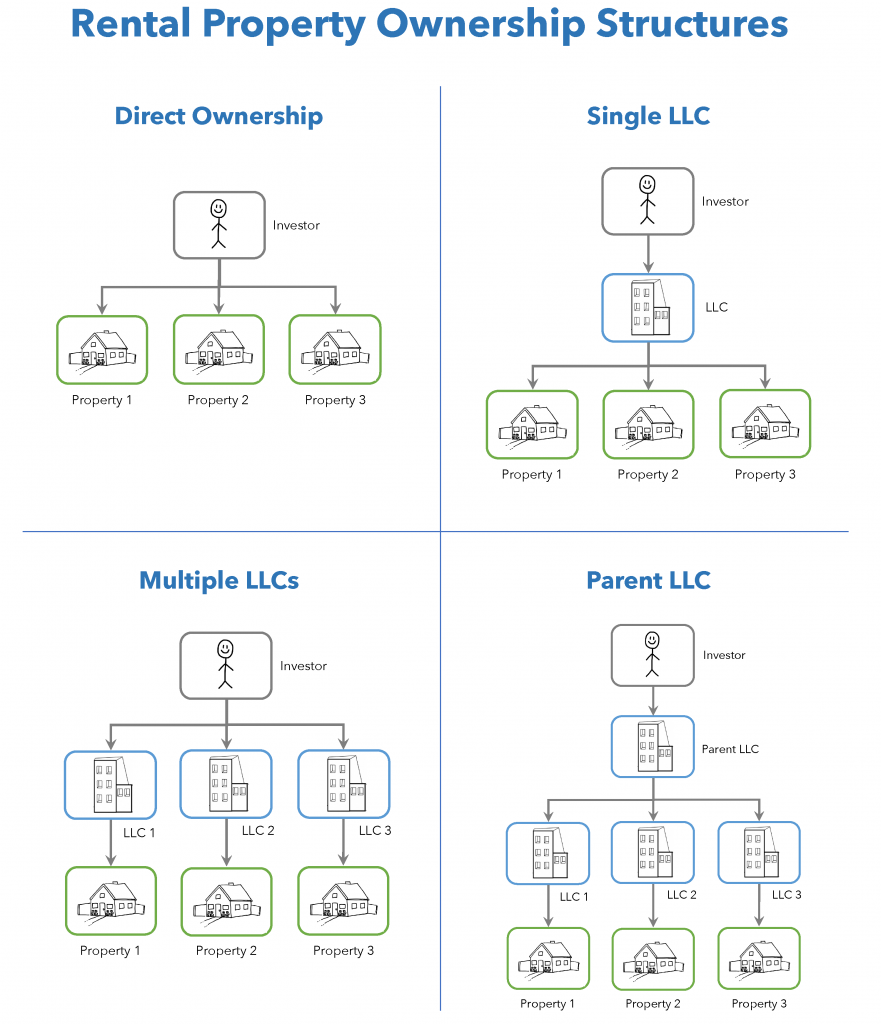

- Customized Structures: The LLC is structured to align with your unique investment needs, optimizing for asset protection, tax benefits, and future growth.

Case Study: Expanding Investments in Florida

A client from Canada recently wanted to invest in rental properties in Florida but was concerned about handling liability and tax implications. He connected with Nobility Consulting‘s experts through our concierge service, who guided him through LLC formation. This setup protected his personal assets from potential property liabilities and provided tax efficiencies to manage his rental income more effectively.

America Mortgages’ LLC formation concierge service is designed to simplify U.S. property ownership so investors can maximize their investment returns and strategy.

The Perfect America Mortgages Loan For Closing Through an LLC

AM Rental Coverage+ allows you to qualify based on the property’s rental income, not your personal income. With loan amounts as low as US$100k and LTVs up to 80% in all 50 U.S. states, this is ideal for seasoned and new real estate investors.

Ready to Form an LLC?

Whether you’re new to U.S. real estate or expanding your portfolio, our LLC formation concierge service, in partnership with Nobility Consulting, offers secure and efficient support tailored to your needs.

Our dedicated team is available 24/7 to assist clients across all time zones. If you’re ready to apply for a U.S. mortgage loan, simply click here. For immediate assistance, call us at +1 (845) 583-0830, or schedule a call with one of our loan officers at your convenience.

Stay tuned for next week’s article on insurance solutions, where we’ll cover protecting your U.S. real estate investments.