Featured Resources

What do Red Packets and U.S. Real Estate have in common?

CNY: The Origin & Traditions More commonly known as Chinese New Year, the Lunar New Year is more than just the beginning of a new calendar year. The Lunar New Year is viewed as a period of gathering and rebirth, denoting the end of winter and the beginning of spring. Legend has it that a […]

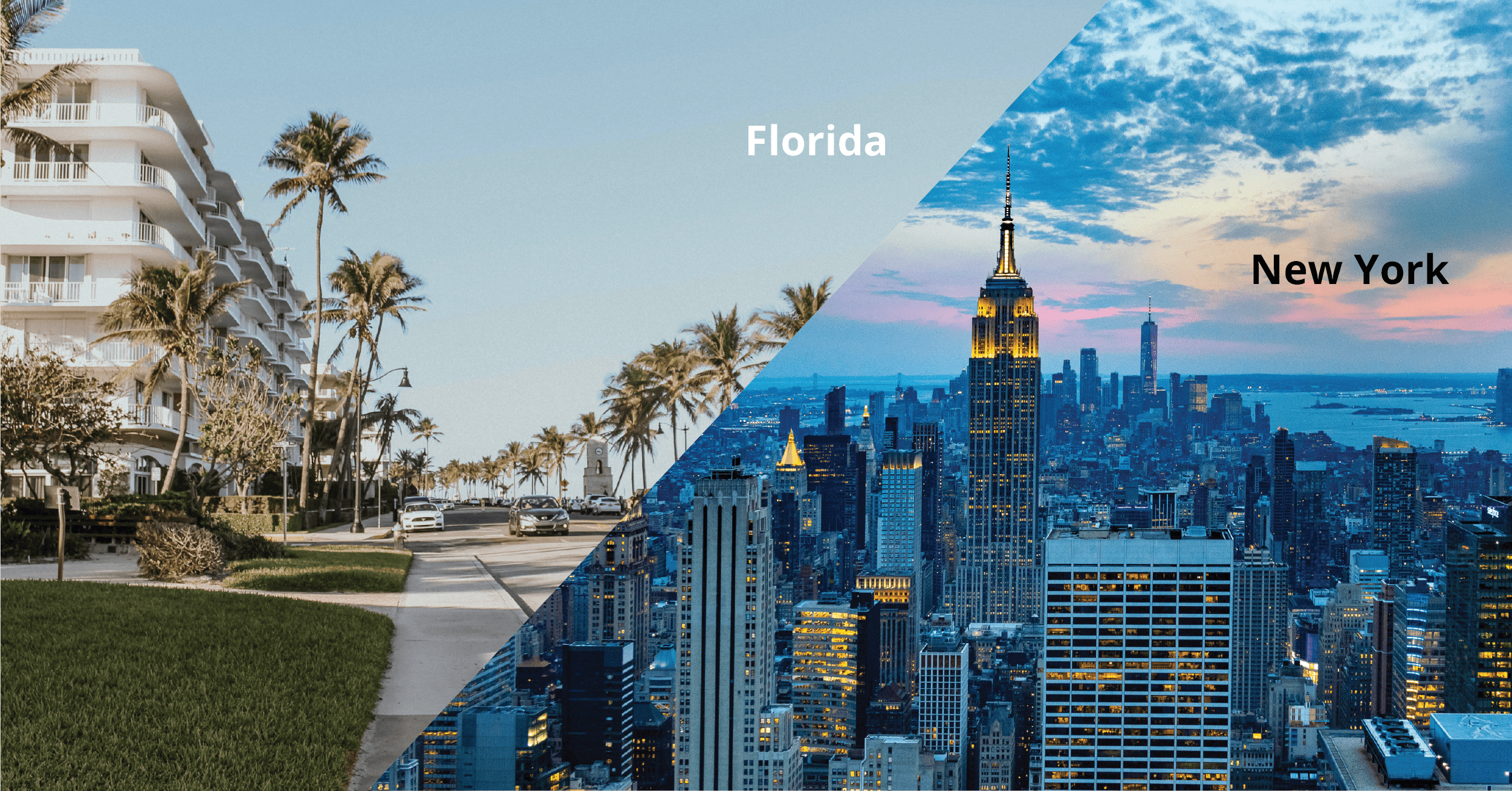

From Florida’s sunny shores to New York’s trophy buildings – we compare real estate prices on the east coast.

America’s East Coast housing market is home to the best real estate to invest in the world. From sunny Florida to New York excitement, we feature the average cost per home, rental prices and cost per square foot. Where do you get the most value for your dollar? Enjoy. Moving or investing in America’s East […]

From Hong Kong to Austin. London to Miami. We compare real estate with the most bang for your buck!

Globally real estate markets are red-hot, and even a pandemic can’t stop it. For the U.S., mortgage applications for foreigners to purchase U.S. real estate have consistently expanded year-over-year as property prices in most global cities have reached record highs. What makes the U.S. real estate market so enticing to investors? Anyone who has invested […]

Our gift to you – No Income Mortgage Loans are back!

We launched the Asset Depletion Program (AM Liquid Portfolio Mortgages) for investors earlier this month, which allows candidates to qualify for a loan using their assets instead of income from employment. This week, we introduce AM No Income Required + for U.S. expats and foreign nationals! No Income Mortgage Loans You can now qualify to purchase or refinance a U.S. property even if you are […]

Is a vacation home a good investment?

Everyone wants to live in The Bu… The Bu is, of course, Malibu, California… known as the mecca for Airbnb rentals as well as Charlie Sheen’s house in ‘Two and a Half Men.’ One thing the pandemic has done for all of us is force us to think about the next stages of our lives […]

The New AM Commercial + is just for you!

If you live outside the United States, finding appropriate financing options for U.S. commercial real estate is extremely challenging. Our team of commercial mortgage professionals understands the requirements of Foreign Nationals, U.S. Expat borrowers regardless of where they earn their income or U.S. credit profile. Presenting AM Commercial +! A commercial mortgage designed specifically for non-resident […]

Let’s schedule a 15-minute call with our U.S. Mortgage Specialist.