Featured Resources

Postcard from Austin

If you have been following the news, it’s no surprise Austin, Texas is by far the most popular destination for US property investors. This was echoed in our Deep Dive report, where we use empirical data to support this conclusion and the drivers behind its strong price appreciation and high (very) high rental yield. I would […]

Tax Strategies for U.S. Real Estate Investors living Overseas

There are many income tax issues that must be considered when a foreign national invests in U.S. real estate. The analysis begins with the foreign national’s tax status in the U.S. tax system: 1) Are they U.S. citizens (dual citizens)? 2) If not, do they hold a “Green Card” that allows permanent U.S. residency status? […]

Tampa is Now the Hottest Housing Market in the U.S.

2022 has been a particularly hot year for the U.S. housing market overall, but in sunny Tampa, Florida, that market is scorching. The city was rated as the hottest market of 2022 by Zillow, outranking other hot markets like Austin, Texas, and Phoenix, Arizona. Overseas buyers likely know Florida for its excellent weather and as […]

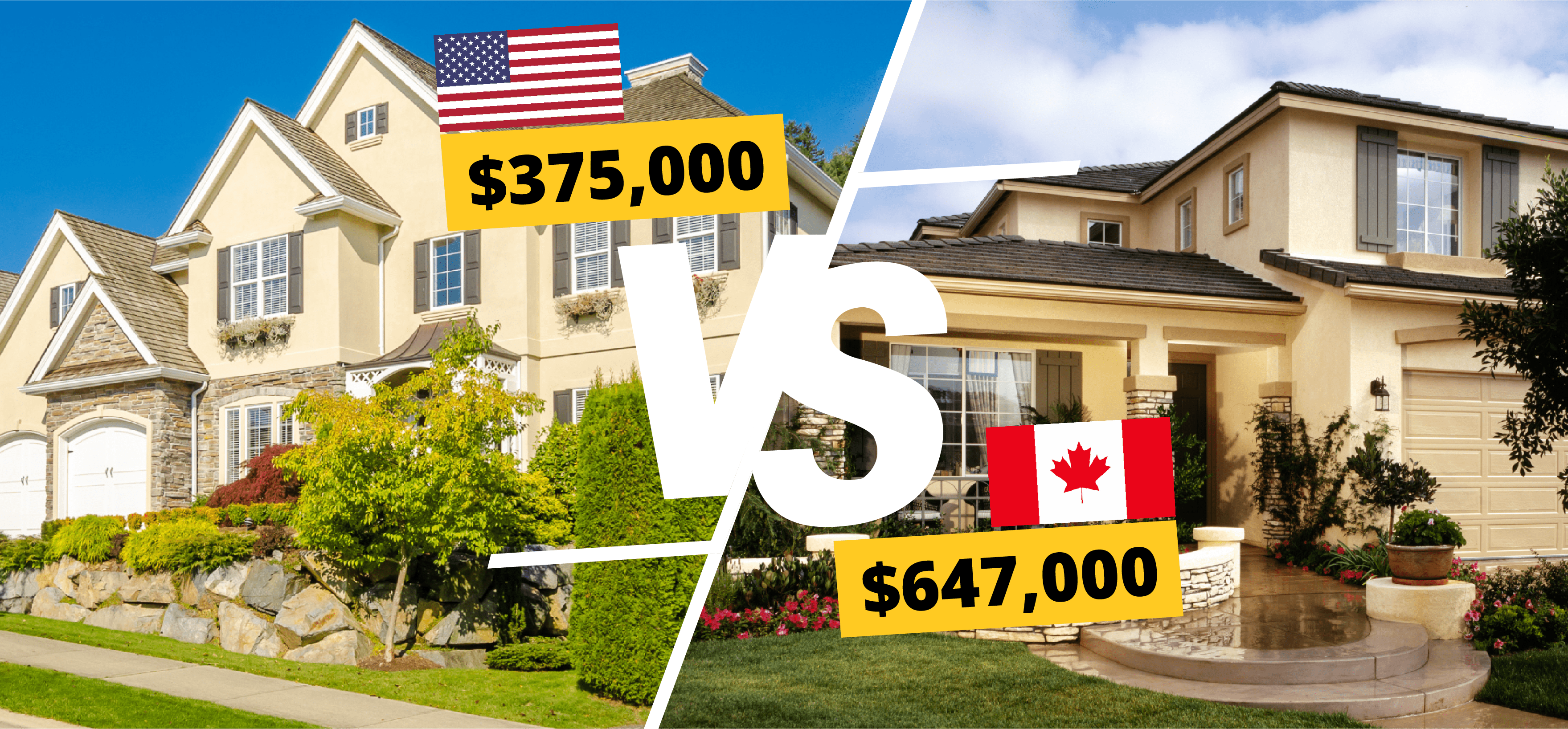

The Standard Home in Canada Now Costs Twice as Much as in the U.S.!

Canada’s housing market is hot. Home prices have rocketed 30% since early 2020, and the Canadian Real Estate Association recently reported that the average price of a Canadian home was nine times the average household income. It wouldn’t be ridiculous to assume that things might be comparable just across the border to the south in […]

Globally How Much Real Estate Can You Get for USD$1 Million?

As a foreign national or U.S. expat investor, real estate remains one of the wisest and most lucrative investments one can make. With technology making the world smaller every day, there is no reason investors shouldn’t be searching out opportunities globally. However, when looking to invest in real estate, getting the best bang for your […]

Top 10 Best Places to Buy a House in the U.S. for Price Appreciation

Whether you’re a foreign national or U.S. expat looking for an overseas investment property, buying real estate in the U.S. can be a wise and lucrative financial decision. However, in a country so vast, diverse, and spread out, choosing the best location can be a daunting task. Luckily, a recent SmartAsset study examined home prices […]

Let’s schedule a 15-minute call with our U.S. Mortgage Specialist.