Featured Resources

Foreign Buyers Flock to U.S. Real Estate Market: Why Now Is the Perfect Time to Invest

The U.S. real estate market is seeing a surge in foreign buyers, as reported by The Wall Street Journal. The COVID-19 pandemic had caused a lull in overseas investments, but now buyers are back and actively purchasing expensive homes, keeping realtors happy. One reason for this trend is the socio-political issues and crises in other […]

Why is Texas the hottest real estate market to invest in globally?

Texas has become one of the hottest real estate markets to invest in globally due to a number of factors that have contributed to its rapid growth and success. Here’s a closer look at why Texas is the hottest real estate market to invest in globally. Firstly, Texas has a booming economy, which is one […]

Maximize Your Investment Potential in Texas: The Lone Star State’s Booming Real Estate Market

Investing in real estate in Texas is becoming an increasingly popular option for those looking to maximize their investment potential. The Lone Star State’s booming real estate market has attracted investors from around the world, and for good reason. Here’s a closer look at why Texas is such an attractive destination for real estate investment. […]

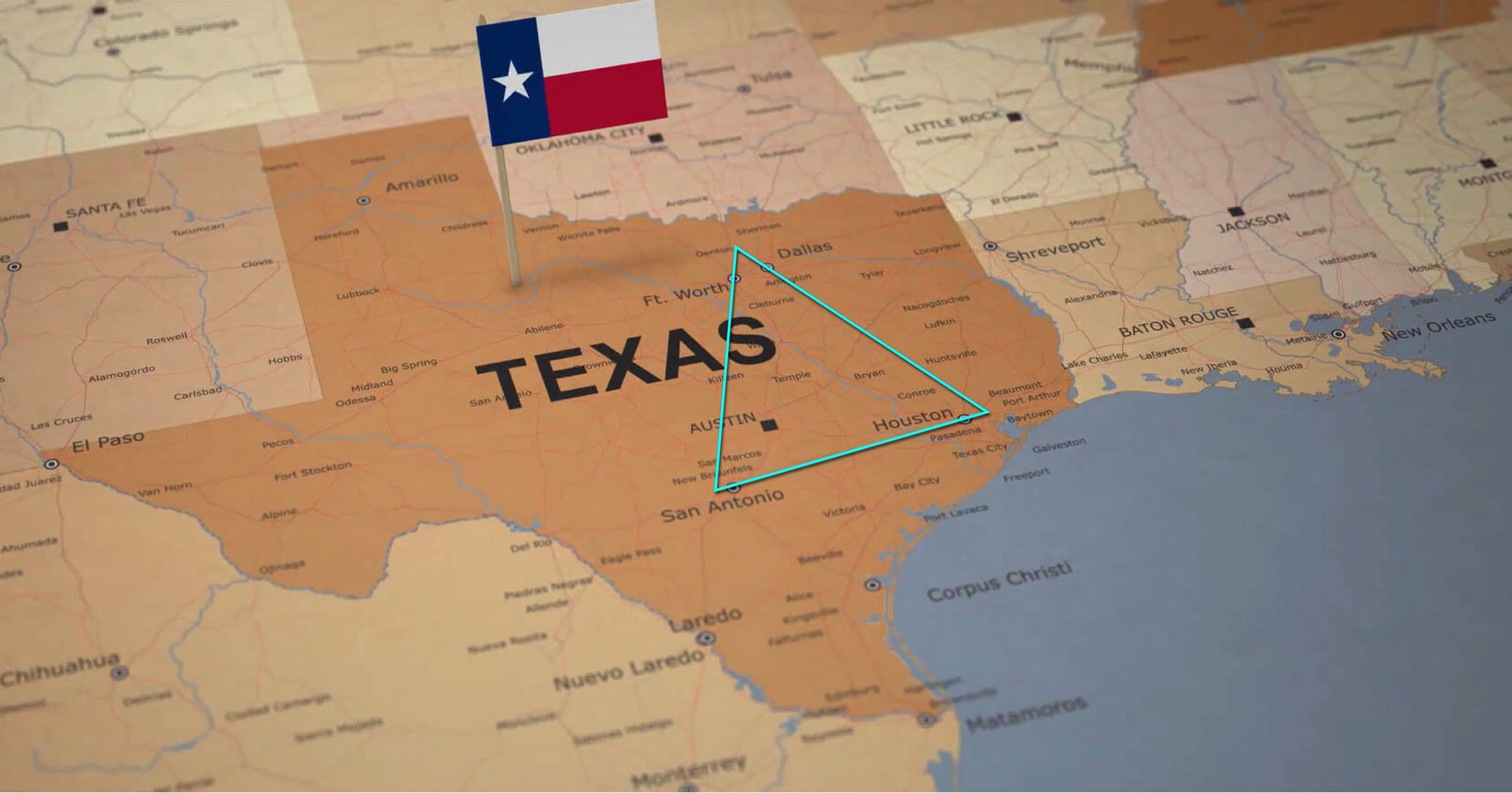

Texas Tri Area: Why Forth Worth, Dallas and Texas are the Ultimate Investment Destination

If you’re a foreign national or U.S. expat looking for the perfect investment destination, look no further than the Texas Tri of Fort Worth, Dallas and Texas. These locations offer a combination of a strong economy, population growth, and a thriving real estate market that make them an excellent investment opportunity for anyone looking to […]

5 Reasons Why U.S. Housing Prices will not Crash but Surprise us!

1. Lack of investment by homebuilders According to data from the U.S. Census Bureau, fewer homes were built in the U.S. in the 10 years following the 2008 financial crisis than in any decade since the 1960s. From 2010 to 2019, a total of 6.8 million new privately-owned housing units were completed in the U.S., significantly […]

Why Fort Worth and Dallas are the Next Hot Spots for Real Estate Investment

Real estate investors, non-residents, and U.S. expats alike are always looking for the next hot spot to invest their money in, and it seems that Fort Worth and Dallas are emerging as the top contenders. These cities offer a unique combination of affordable living, business-friendly policies, and a thriving economy that make them the perfect […]

Let’s schedule a 15-minute call with our U.S. Mortgage Specialist.