Here’s this week’s top news in the U.S. real estate market. These highlights offer potential opportunities for U.S. expats and non-resident investors. Let’s dive into the news and insights that might shape your investment strategy.

KKR Acquires Multifamily Portfolio and Other Implications

KKR’s recent acquisition of Quarterra’s $2.1 billion multifamily portfolio has sparked considerable interest in the U.S. real estate scene. The strategic move reflects KKR’s confidence in the stability and growth potential of multifamily properties in U.S. markets. For U.S. expats and foreign national investors, the KKR investment suggests opportunities in multifamily properties, which our clients may want to explore.

At America Mortgages, we offer tailor-made lending solutions that help investors leverage multifamily assets similar to those acquired by KKR.

America Mortgages offers this loan program to help you invest using the KKR strategy;

AM Multi-family +

- 5-8 units (one property)

- Minimum loan amount: US$250,000

- Loan-to-Value: up to 75% for purchase & 70% for cash-out

- Underwritten on property cash flow

- No U.S. credit required

- Foreign National and U.S. Expat

- No personal income required

- Closing in 30-45 days

Investors can qualify based on property cash flow, making the process easy and flexible when investing in U.S. real estate.

Read the article: KKR acquires $2.1 bln portfolio of multifamily real estate assets from Quarterra

Manhattan’s Surge in Home Sales

Manhattan home sales surged unexpectedly, with closings on apartments up 12.2% in the second quarter. This surge is powered by an increase in buyer activity aiming to take advantage of current market conditions before any Federal Reserve rate adjustments. This uptick indicates a strong demand in the market and a perfect timing for foreign national and U.S. expat investors who are looking to take part in Manhattan’s prestigious real estate market before potential price escalations after interest rates decrease. Marry the property. Date the rate.

America Mortgages offers a well-positioned loan program to help you invest in U.S. real estate as a foreign investor or U.S. Expat;

AM CashFlow +

- 1-4 units (one property)

- Minimum loan amount: US$100,000

- Loan-to-Value: up to 80% for purchase & 70% for cash-out

- Underwritten on property cash flow

- No U.S. credit required

- Foreign National and U.S. Expat

- No personal income required

- Closing in 30-45 days

Read the article: Manhattan Home Sales Unexpectedly Rise as Buyers Cave on Rate Cuts

Barbara Corcoran’s Best Cities for Real Estate Investing

World famous “rags to riches” real estate investor Barbara Corcoran has identified three cities poised for significant growth and investment potentials:

- Pittsburgh, Pennsylvania: With an average home value of $227,329, Pittsburgh has seen a 6.2% increase in home values in the last year. The city has diverse advanced manufacturing and a strong base in education, hosting many colleges and universities.

- Columbus, Ohio: Columbus’s average home value is $243,838, up 6.9% year over year. Its strong business climate, with major companies like JPMorgan Chase and Nationwide based there, contributes to a strong demand for housing.

- Indianapolis, Indiana: Indianapolis’s average home value is $224,099, up 2.3% in the past year. Known for its diverse economy driven by the education, healthcare, and finance sectors, Indianapolis also benefits from sports tourism and major events like the Indianapolis 500.

These cities represent strategic investment opportunities where home prices are expected to rise due to economic growth, job creation, and strategic market conditions. For foreign national and U.S. expat investors looking to diversify their portfolios, Barbara Corcoran’s recommendations provide valuable insights into emerging markets with major potential for long-term investment.

AM Investor +

- 1-4 units (one property)

- Minimum loan amount: US$150,000

- Loan-to-Value: up to 75% for purchase & 70% for cash-out

- Underwritten using an income letter and not personal tax returns

- No U.S. credit required

- Foreign National

- No tax returns required

- Closing in 30-45 days

Read the article: Barbara Corcoran: 3 Cities To Invest in Real Estate Now Before Prices Skyrocket

The Hedge Against Inflation

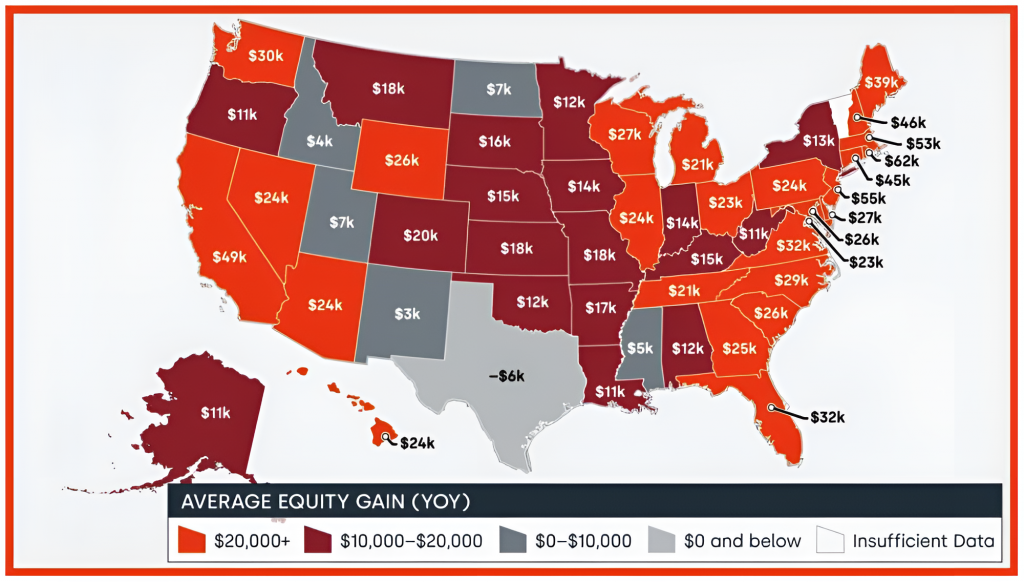

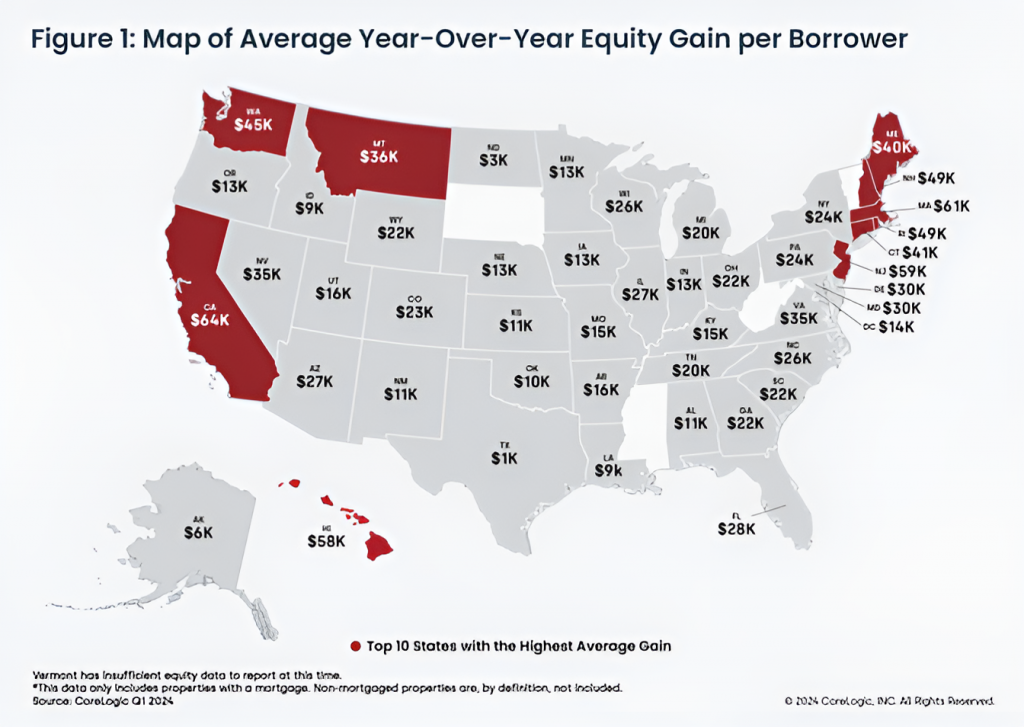

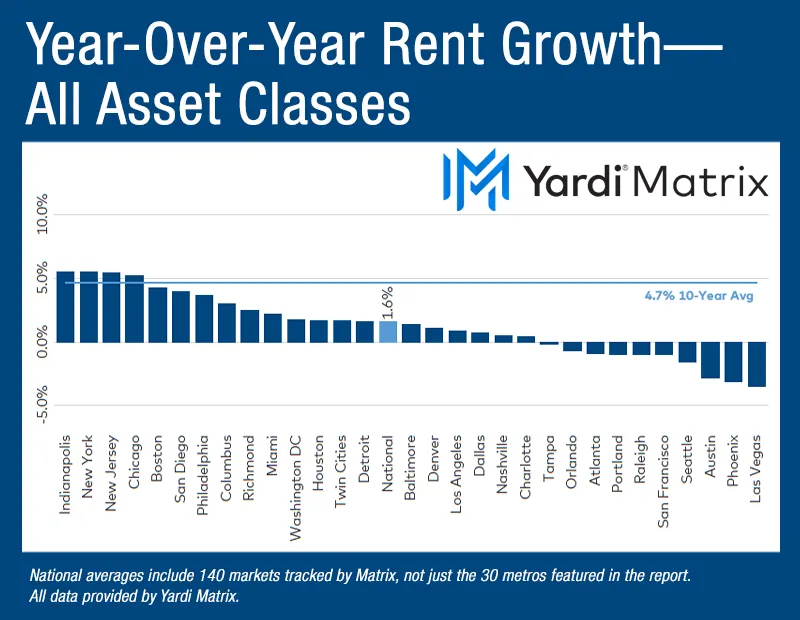

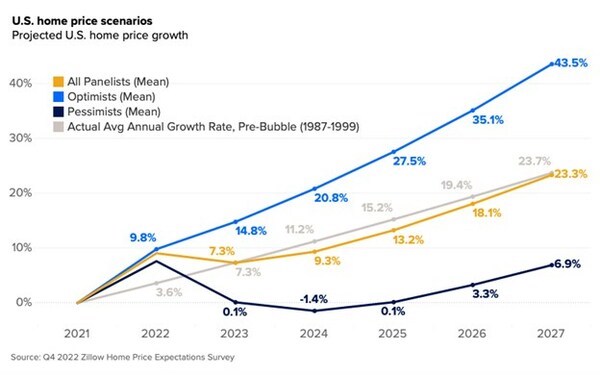

It turns out that owning a home was likely your best bet for hedging against inflation during this cycle. This chart from “A Wealth of Common Sense” illustrates the performance of real estate as an inflation hedge.

Historically, real estate has consistently outperformed inflation, protecting investors’ purchasing power over the long term. This is especially relevant in the current economic climate, where inflation rates have been rising steadily. The stability and growth of real estate values provide a reliable safeguard against the effects of inflation, making it a tactful choice for investors looking to preserve their wealth.

This week’s news highlights often overlooked opportunities from industry experts in the U.S. real estate market. From KKR’s strategic investment in multifamily properties to Manhattan’s surge in sales activity and Barbara Corcoran’s city picks for growth and profits, the U.S. real estate market offers diverse avenues for growth and profitability.

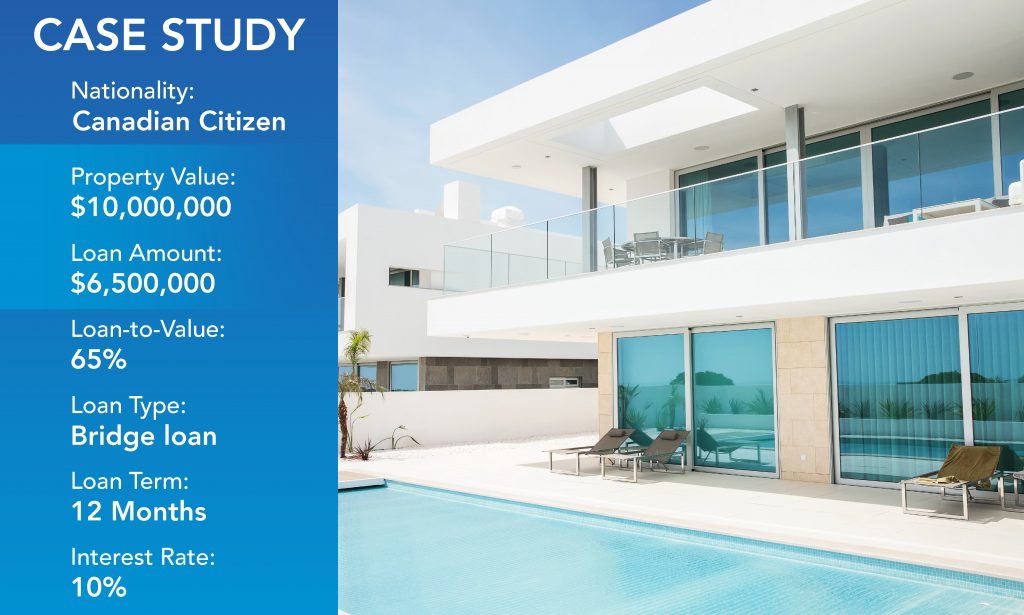

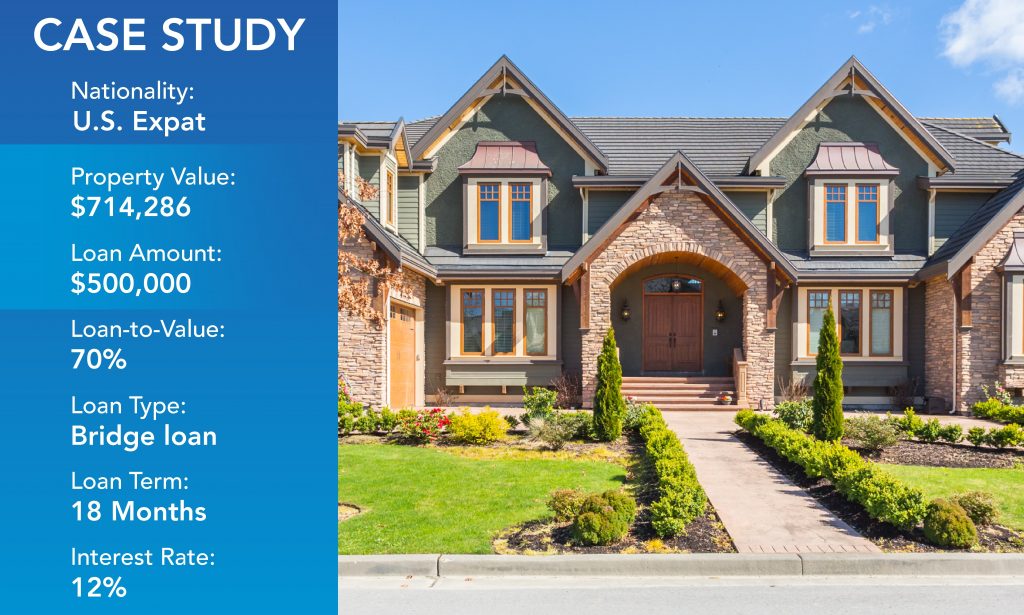

At America Mortgages, we’re dedicated to helping U.S. expats and foreign nationals navigate these opportunities with confidence. Whether you’re interested in multifamily investments, luxury properties in Manhattan, or overlooked markets like Pittsburgh and Columbus, our specialized financing solutions and expert guidance are here to support your investment journey.

We work in your time zone, speak your language, and know this type of mortgage lending better than any other company in the industry. Use our 24/7 calendar link to schedule a meeting with one of our loan officers, and visit www.americamortgages.com to learn more about how we can help you achieve your real estate investment goals.

As always, thank you for your trust and your business. We look forward to a successful closing!