We’re making U.S. real estate investment more accessible than ever at America Mortgages. With our new reduced mortgage loan minimum of $100,000, owning property in the U.S. is now easier for new and seasoned real estate investors. Whether you’re a foreign national looking to build wealth in the U.S. or a U.S. expat seeking to invest back home, we’ve made it easier to take that first step.

Lower Minimum Loan Amount: $100,000

Lowering the loan minimum to $100,000 opens the door for more investors to access the U.S. real estate market. With a lower loan minimum and a maximum LTV (loan-to-value) of 80%, investors can start by purchasing an entry-level property. For seasoned investors, the newly adjusted loan minimum allows you to diversify your portfolio by investing in multiple properties or regions, spreading risk while maximizing growth potential.

Our reduced loan minimum breaks down barriers, giving you the opportunity to invest in U.S. real estate without the need for a large initial investment.

Introducing the Rental Coverage+ Loan Program: It’s All About DSCR

Our Rental Coverage+ Loan Program is specifically designed for international investors, this program simplifies the qualification process by focusing on the property’s income potential rather than personal financial details. Instead of focusing on your personal income or credit history, we use Debt Service Coverage Ratio (DSCR) to qualify. We like to call it “common sense underwriting”.

What’s DSCR, and Why Does It Matter?

DSCR evaluates how well the rental income from your property can cover its loan payments. Simply put, the focus is on the property’s income potential, not your personal finances. This approach is ideal for investors looking for a straightforward qualification process and the confidence to grow their portfolio.

In simple terms, if the monthly rental income can cover on a 1:1 ratio the mortgage payment, property taxes and insurance the loan qualifies. It’s that simple.

Key Features of the Program:

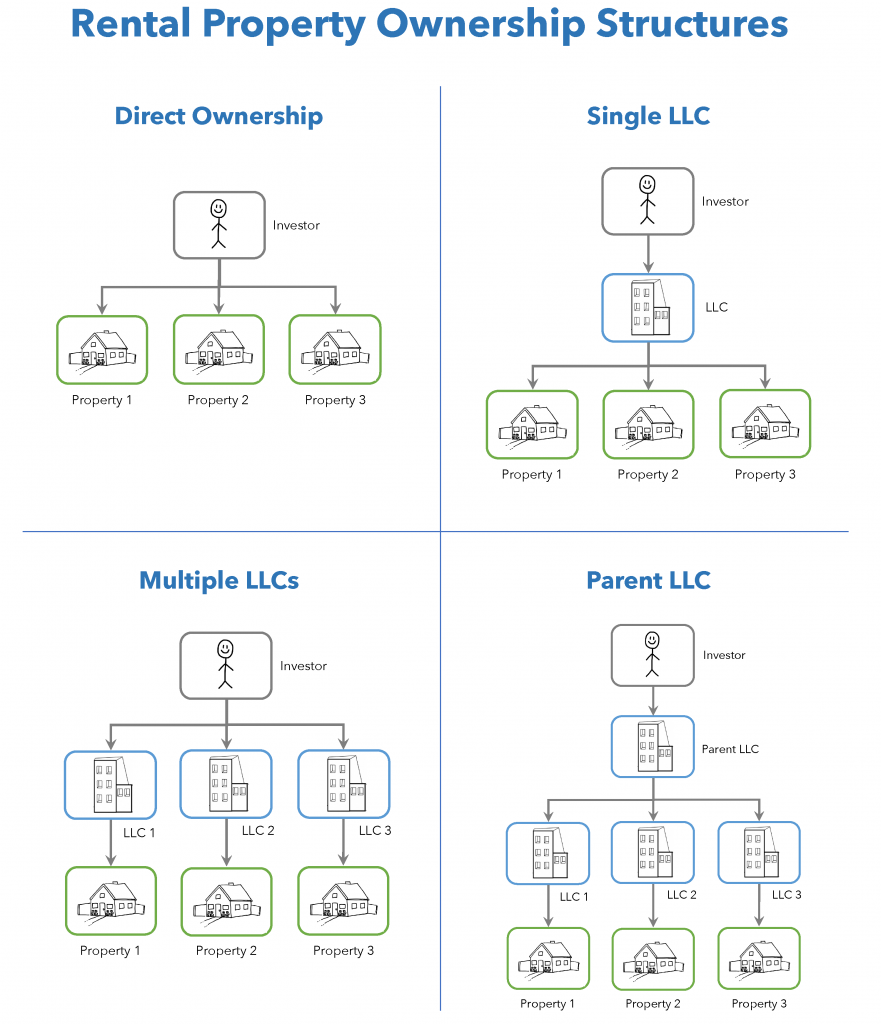

- Minimum Loan Amount: $100,000 and above for properties held in an LLC. Want to get a mortgage in your personal name? The minimum loan amount is only $150,000.

- Loan-to-Value: Up to 80% for purchases and 70% for cash-out refinances.

- Underwriting: Based on the property’s rental income, with no personal income documents required.

- Credit Requirements: No U.S. credit required.

- Closing Time: Quick, with closings in 30-45 days.

Why America Mortgages Is Your Best Choice

At America Mortgages, we don’t just offer loans—we deliver solutions. Here’s why we’re the go-to choice for international investors:

- We’re a Direct Lender: Being a direct lender means we handle everything in-house, giving you faster approvals and competitive rates.

- We’re a Super Broker: With in-house lending, access to over 150 partners, and exclusive expertise in working with international clients, America Mortgages ensures a seamless process tailored to your needs.

- We Know International Investors: We work exclusively with international clients, so we understand your challenges and offer tailored solutions to meet your needs.

- Your Investment, Simplified: From reduced loan amounts to DSCR-based qualification, we’re making U.S. real estate investing easier and more accessible than ever.

Invest in Any U.S. State—The Choice Is Yours

With our programs available across all 50 states, you have the freedom to invest where it makes the most sense for you. Whether you’re eyeing a booming market or a high-demand rental area, we’ve got you covered.

Your U.S. Real Estate Investment Starts Here

At America Mortgages, we’re here to make the process simple, fast, and secure. Whether you’re new to investing or a seasoned pro, our team is ready to help you achieve your goals with the best financing options available.

Get started on your U.S. real estate investment today. Speak with a loan officer by calling +1 (845) 583-0830, email us at [email protected], or visit www.americamortgages.com to explore your options.

Nuevo Monto de Préstamo Reducido a $100,000: Ahora Todos Pueden Ser Inversionistas de Bienes Raíces en EE. UU.

En America Mortgages, estamos haciendo que la inversión en bienes raíces en EE. UU. sea más accesible que nunca. Con nuestro nuevo monto mínimo de préstamo reducido a $100,000, ser propietario de una propiedad en EE. UU. ya no es exclusivo de grandes inversionistas. Ya sea que seas un extranjero buscando construir riqueza en EE. UU. o un expatriado estadounidense deseando invertir en casa, hemos hecho más fácil dar ese primer paso.

Monto Mínimo de Préstamo Reducido: $100,000

Reducir el monto mínimo del préstamo a $100,000 abre las puertas para que más inversionistas accedan al mercado inmobiliario de EE. UU. Con un requisito de capital menor, puedes comenzar adquiriendo una propiedad de nivel inicial en un mercado emergente, facilitando así tu primer paso. Esto también te permite diversificar tu portafolio invirtiendo en múltiples propiedades o regiones, reduciendo riesgos mientras maximizas el potencial de crecimiento.

Nuestro monto mínimo reducido elimina barreras, ofreciéndote la oportunidad de invertir en bienes raíces en EE. UU. sin necesidad de una inversión inicial grande.

Presentamos el Programa de Préstamos Rental Coverage+: Todo Se Trata del DSCR

Diseñado específicamente para inversionistas internacionales, nuestro Programa de Préstamos Rental Coverage+ simplifica el proceso de calificación al centrarse en el potencial de ingresos de la propiedad en lugar de los detalles financieros personales. En lugar de evaluar tus ingresos personales o historial crediticio, utilizamos la Razón de Cobertura del Servicio de Deuda (DSCR) para calificar.

¿Qué es DSCR y Por Qué Es Importante?

DSCR evalúa qué tan bien los ingresos de alquiler de tu propiedad pueden cubrir los pagos del préstamo. En términos simples, el enfoque está en el potencial de ingresos de la propiedad, no en tus finanzas personales. Este enfoque es ideal para inversionistas que buscan un proceso de calificación sencillo y la confianza para hacer crecer su portafolio.

Características Principales del Programa:

- Monto Mínimo de Préstamo: $100,000 para propiedades bajo una LLC o $150,000 para propiedades a tu nombre.

- Relación Préstamo-Valor: Hasta el 80% para compras y 70% para refinanciamientos con retiro de efectivo.

- Subrogación: Basada en los ingresos por alquiler de la propiedad, sin necesidad de ingresos personales.

- Requisitos de Crédito: No se requiere crédito en EE. UU.

- Tiempo de Cierre: Rápido, con cierres en 30-45 días.

Por Qué America Mortgages Es Tu Mejor Elección

En America Mortgages, no solo ofrecemos préstamos: brindamos soluciones. Aquí tienes las razones por las que somos la opción ideal para inversionistas internacionales:

- Somos Prestamistas Directos: Como prestamistas directos, manejamos todo internamente, brindándote aprobaciones más rápidas y tasas competitivas.

- Somos Súper Brokers: Con préstamos internos, acceso a más de 150 socios y una experiencia exclusiva trabajando con clientes internacionales, garantizamos un proceso fluido adaptado a tus necesidades.

- Entendemos a los Inversionistas Internacionales: Trabajamos exclusivamente con clientes internacionales, comprendemos tus desafíos y ofrecemos soluciones personalizadas.

Tu Inversión, Simplificada

Desde montos de préstamo reducidos hasta calificaciones basadas en DSCR, estamos haciendo que la inversión en bienes raíces en EE. UU. sea más fácil y accesible que nunca.

Invierte en Cualquier Estado de EE. UU.—La Elección Es Tuya

Con nuestros programas disponibles en los 50 estados, tienes la libertad de invertir donde más te convenga. Ya sea que busques un mercado en auge o una zona de alta demanda de alquiler, estamos aquí para apoyarte.

Tu Inversión en Bienes Raíces en EE. UU. Comienza Aquí

En America Mortgages, estamos para hacer el proceso simple, rápido y seguro. Ya sea que seas nuevo en la inversión o un profesional experimentado, nuestro equipo está listo para ayudarte a alcanzar tus objetivos con las mejores opciones de financiamiento disponibles.

Comienza tu inversión en bienes raíces en EE. UU. hoy mismo. Habla con un oficial de préstamos llamando al +1 (845) 583-0830, envíanos un correo a [email protected] o visita www.americamortgages.com para explorar tus opciones.

贷款额度降至$100,000:现在人人都能成为美国房地产投资者

在America Mortgages,我们让美国房地产投资变得比以往更加便捷。随着我们新的最低贷款额度降低至$100,000,拥有美国房产不再是大型投资者的专属。不管您是想在美国积累财富的外国投资者,还是希望回国投资的美国侨民,我们让您更容易迈出第一步。

更低的最低贷款额度:$100,000

将最低贷款额度降至$100,000,为更多投资者打开了进入美国房地产市场的大门。通过较小的资本要求,您可以从购买新兴市场的入门级房产开始,这使迈出第一步更加容易。这还允许您通过投资多处房产或不同地区来分散投资组合,降低风险,同时最大化增长潜力。

我们降低的贷款门槛打破了障碍,让您无需大额初始投资就能进入美国房地产市场。

全新推出的Rental Coverage+贷款计划:核心是DSCR

我们的Rental Coverage+贷款计划专为国际投资者设计,通过专注于房产的收入潜力,而非个人财务细节,简化了资格认证过程。与其关注您的个人收入或信用记录,我们通过**债务服务覆盖比率(DSCR)**来进行资格认证。

什么是DSCR,为什么它很重要?

DSCR评估您的房产租金收入是否足以覆盖贷款还款。简单来说,重点在于房产的收入潜力,而不是您的个人财务状况。这种方法非常适合那些希望通过简单的资格认证流程,增强投资组合信心的投资者。

计划的主要特点:

- 最低贷款额度:通过LLC持有的房产最低$100,000,以个人名义持有的房产最低$150,000。

- 贷款与价值比(LTV):购买房产最高可达80%,现金再融资最高可达70%。

- 审核标准:基于房产租金收入,无需个人收入证明。

- 信用要求:无需美国信用记录。

- 审批时间:快速,通常在30-45天内完成。

为什么选择America Mortgages?

在America Mortgages,我们不仅提供贷款,更提供解决方案。以下是国际投资者选择我们的原因:

- 我们是直接贷款机构:作为直接贷款机构,我们内部处理所有事务,为您提供更快的审批和更具竞争力的利率。

- 我们是超级经纪人:通过内部贷款、超过150家合作伙伴的资源,以及在服务国际客户方面的独特专业知识,我们确保流程顺畅且量身定制。

- 我们了解国际投资者:我们专注于国际客户,因此我们理解您的挑战,并提供满足您需求的定制化解决方案。

您的投资,简单化

从降低的贷款额度到基于DSCR的资格认证,我们让美国房地产投资变得前所未有的简单和可及。

在美国任何州投资——选择权在您手中

我们的计划适用于所有50个州,您可以自由选择最适合自己的投资地点。不论您看中的是快速发展的市场还是高需求的租赁区域,我们都能满足您的需求。

您的美国房地产投资,从这里开始

在America Mortgages,我们致力于让整个流程变得简单、快速且安全。无论您是初次投资者还是经验丰富的专业人士,我们的团队都随时准备为您提供最佳融资方案,帮助您实现目标。立即开始您的美国房地产投资。请拨打+1 (845) 583-0830与贷款专员联系,发送电子邮件至[email protected],或访问www.americamortgages.com了解更多选项。