We are the Industry Experts in Non-Resident U.S. Mortgage Lending

Our global team of U.S. Mortgage Specialists are ready to help you.

Ready to be part of that success story? Reach out today, and let’s get your U.S. property journey started on the right foot.

Our simple process

We have eliminated many unnecessary steps to create a simple and easy process for our clients.

-

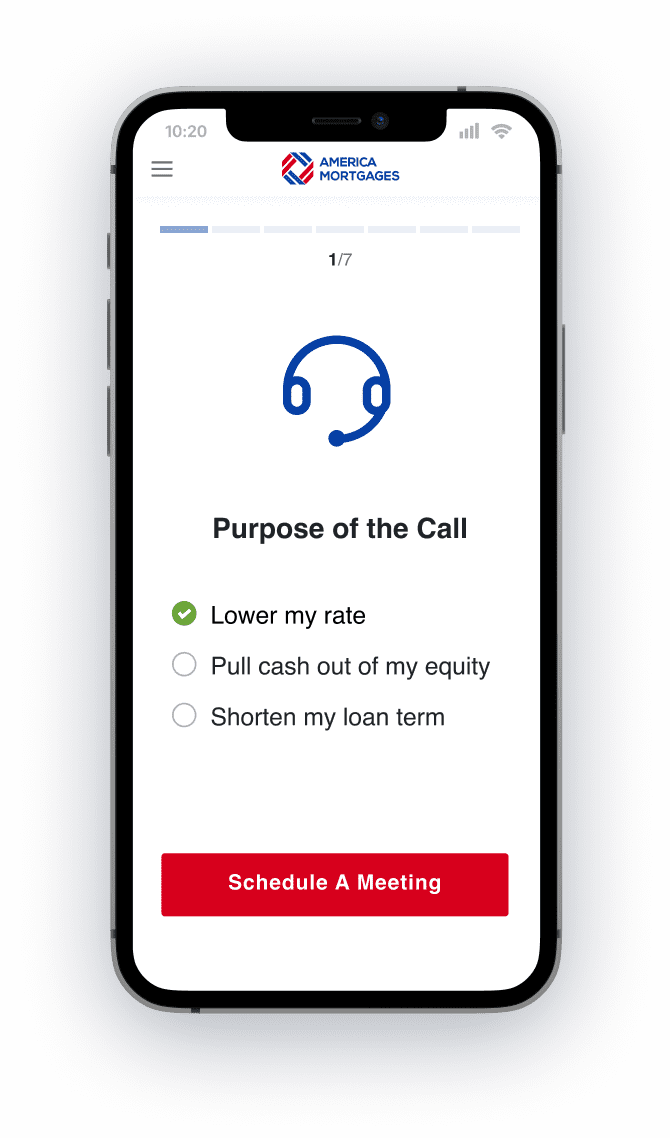

Speak to our U.S. Mortgage Specialist

Our Loan Officers will understand your requirements and introduce our loan programs.

-

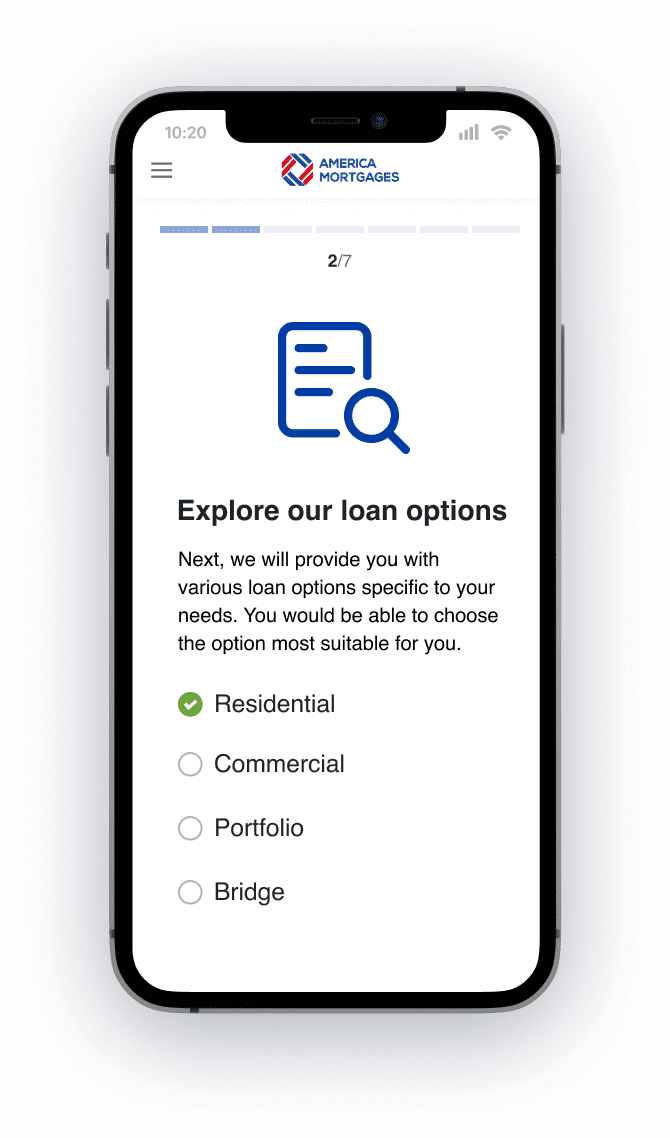

Explore our loan options

After your initial call, we will provide you with various loan options specific to your needs.

-

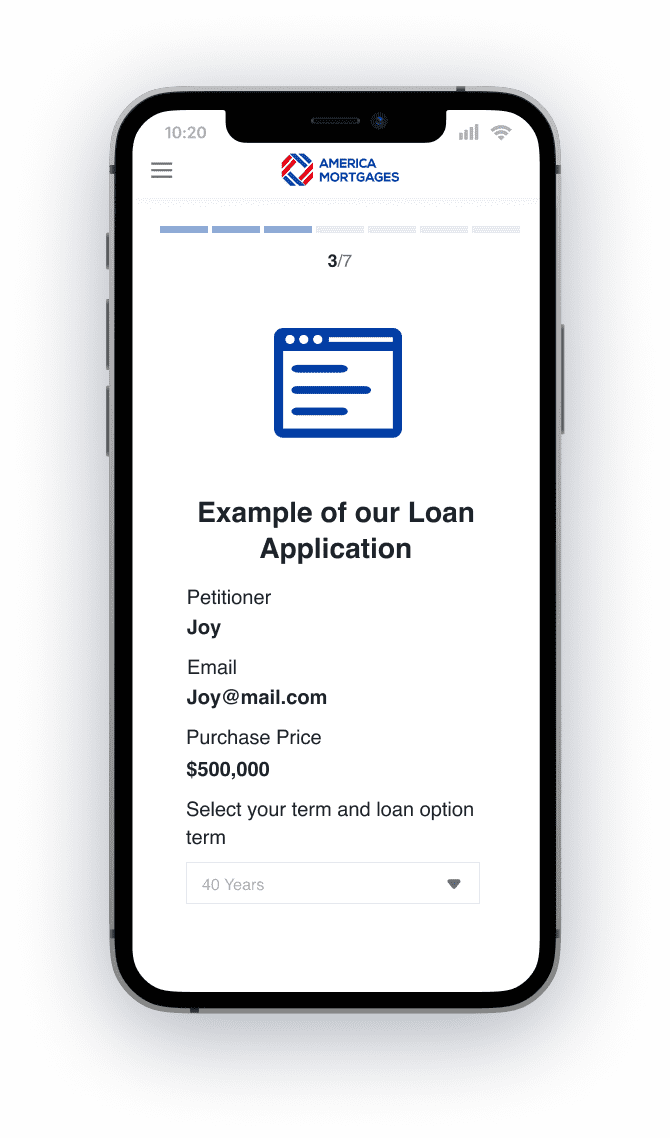

Complete application

We have developed a process that is easy and have eliminated many unnecessary steps. We are here to help.

-

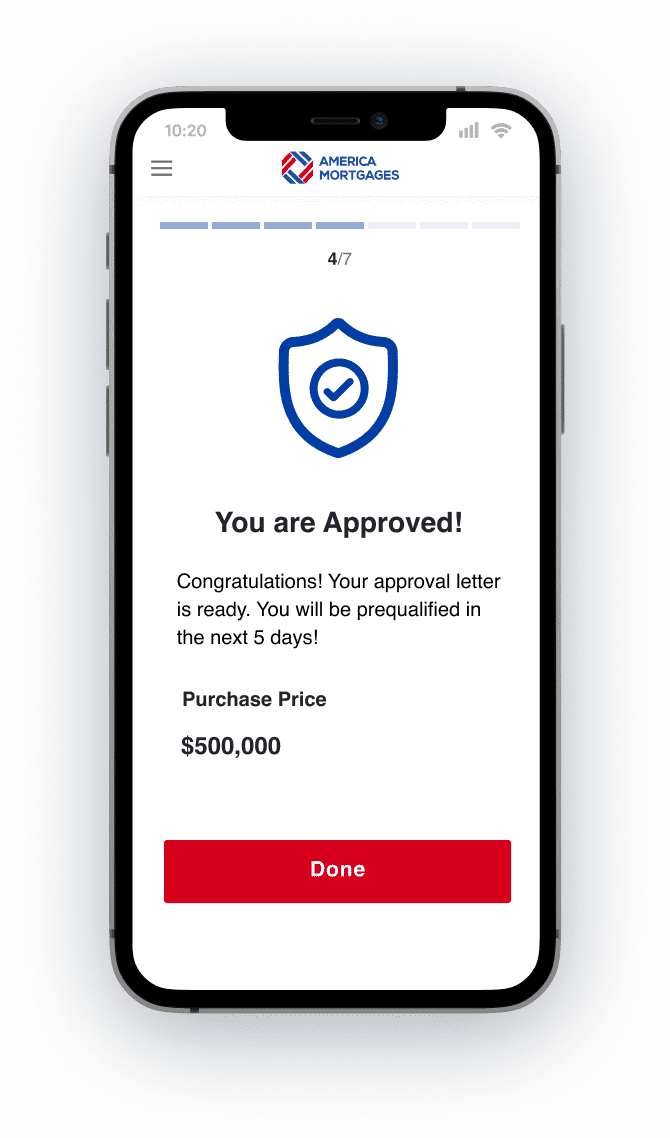

Get loan-approval

Once the application is submitted to the lender, a

Pre-approval will be issued within 5 days. -

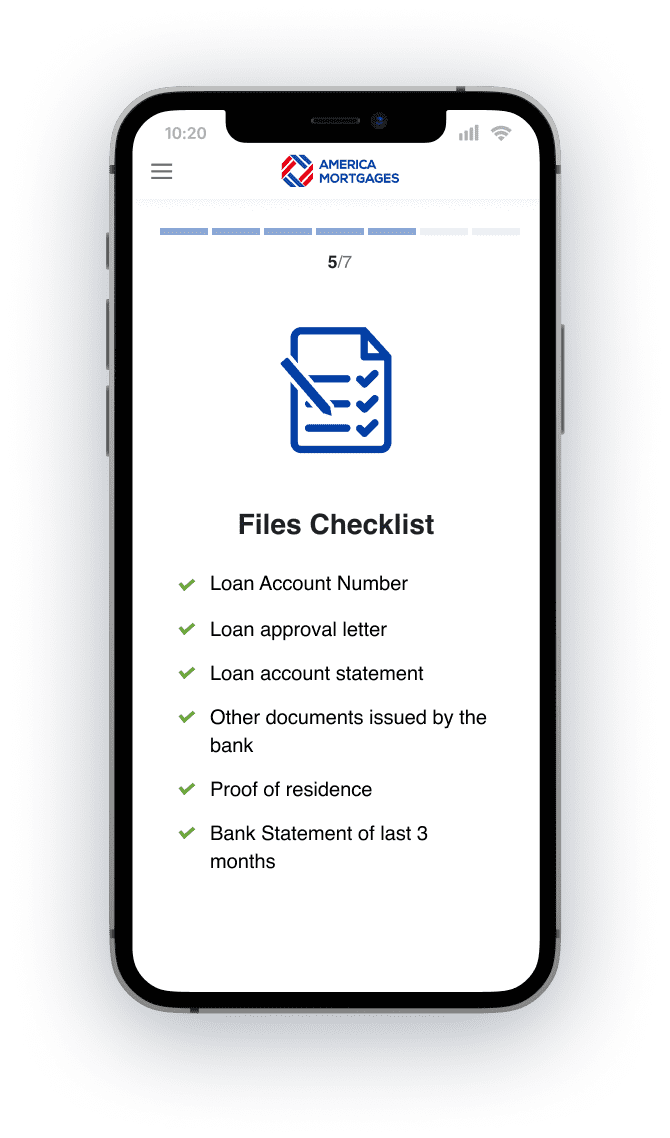

Clear Conditions

Our Loan Officer will work with you to gather the remaining documents required by underwriting.

-

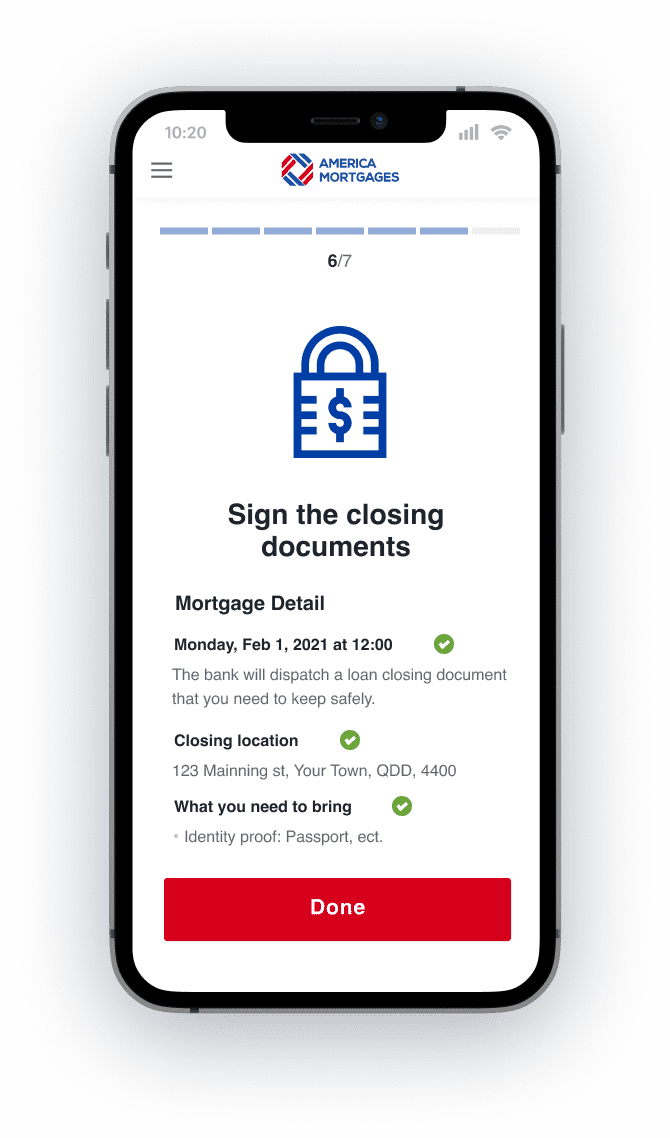

Signing the documents

Sign the closing documents at your local embassy and within a few days your loan will be funded!

-

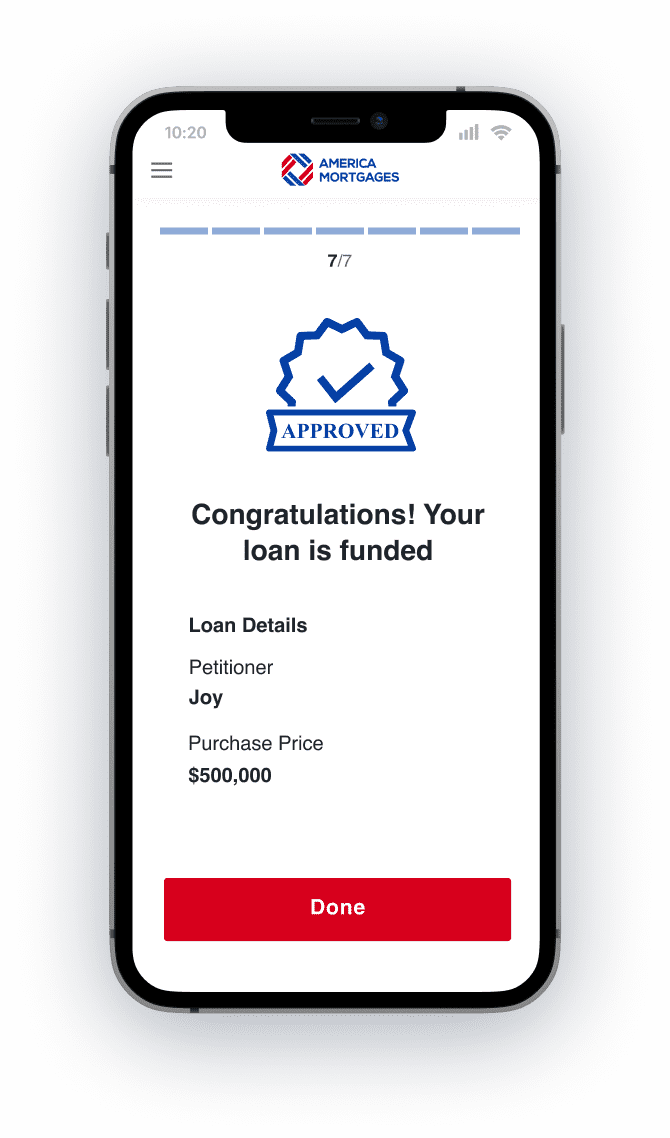

Congratulations – Your loan is funded!

You have now used a mortgage to maximize your cash-flow.

Loan Programs We Offer

Investment Loans (Foreign Nationals & U.S. Expats)

- DSCR Loans – Qualify using rental income, not personal income. Up to 80% LTV, no U.S. credit needed.

- Negative Cashflow Flex – Approvals even if the property doesn’t cash-flow (DSCR < 1.0). Perfect for renovations or growth markets.

- Pure Investment Property Loans – Tailored for rentals, multifamily, or commercial properties. Loan sizes up to $3M.

Second Home Loans (Foreign Nationals & U.S. Expats)

- Finance vacation homes, family residences, or student housing in the U.S.

- Up to 80% LTV for U.S. expats | 75% for foreign nationals.

- Overseas income and assets accepted, no U.S. tax returns required.

Wealth & Asset-Based Loans (High-Net-Worth & Retirees)

- Asset Depletion Loans – Use savings, investments, or retirement accounts instead of income.

- Cash-Out Refinance – Tap into your U.S. property equity for investments, business, or personal needs.

- Equity Release – Unlock property value without selling. Flexible terms up to 30 years.

Specialty Programs (Global Investors)

- Bridge Loans – Close in as little as 2 weeks, up to 70% LTV, asset-based qualification.

- Portfolio Loans – Finance multiple U.S. properties with one simple loan.

- Commercial Loans – For multifamily, office, mixed-use, and retail investments. Accepts foreign income & global assets.

Additional Programs

- No-income loans for self-employed borrowers.

- Tailored HNW programs without asset-under-management requirements.

Why Choose Us?

- 97% approval rate | $480M funded last year | Clients in 57 countries

- 100% dedicated to foreign nationals & U.S. expats

- No U.S. credit, tax returns, or residency required

- Direct lender + super broker model (150+ U.S. banks & programs)

- Multilingual support | Seamless closings in all 50 states

America Mortgages’ Reviews

Concierge Services We Offer

America Mortgages’ Concierge Service is committed to helping international and expat real estate investors achieve their goals in maximizing their U.S. real estate returns. To assist in this effort, we have teamed up with vetted key players in U.S. insurance, tax advisory, money transfer, and wealth management.

As seen in

Schedule a call with our U.S. Mortgage Specialist.

Foreign National and U.S. Expat Mortgage Blogs

Learn how to qualify for a U.S. mortgage loan as a non-U.S. resident through case studies, articles, and useful blogs