We are the Industry Experts in Non-Resident U.S. Mortgage Lending

Our global team of U.S. Mortgage Specialists are ready to help you.

Leading Experts in Foreign National and U.S. Expat Mortgage Loans

When it comes to securing a mortgage for non-residents looking to buy, refinance, cash-out or release equity from property in the United States, experience matters more than anything. At America Mortgages, we’ve built our reputation as the go-to specialists for foreign national mortgage loans and U.S. expat home financing. Whether you’re an international investor eyeing an investment condo in Boston, a vacation home in Florida or an apartment for your child attending university in the USA, to a U.S. citizen living abroad who wants to refinance a property or purchase a new condo back home, our dedicated global team of U.S. mortgage experts is here to guide you every step of the way.

We’ve helped countless clients navigate the complexities of non-resident U.S. mortgages, from visa considerations to credit requirements tailored for those without a traditional U.S. financial history. Unlike “traditional” lenders, banks and brokers located in America, you’ll find that our exclusive focus sets us apart, we don’t dabble in domestic loans; this is our sole expertise, ensuring you get the most tailored solutions available. Our clients are clients just like you.

Impressive 97% Approval Rate for Non-Resident Borrowers

One of the biggest hurdles for foreign nationals and U.S. expats is getting approved for a U.S. mortgage, especially when dealing with lenders who aren’t fully versed in international financing. That’s where we shine. With a staggering 97% approval rate, we’re incredibly proud of our track record in providing reliable U.S. mortgage financing for non-U.S. residents.

How do we achieve this? It’s simple: This isn’t a side-business for us, non-resident lending is all we do. With loan programs from cash-flow and negative cash-flow DSCR to alternative income, we skip the one-size-fits-all approach that you might encounter with broader lenders and instead dive deep into your unique situation. Whether that means leveraging foreign income sources, alternative credit verification, no U.S. credit, or flexible down payment options. This laser-focused expertise means fewer roadblocks, faster processing, and a smoother path to owning U.S. real estate. If you’re tired of denials from generalist brokers, lenders and banks, let’s talk about how we can turn your “maybe” into a resounding “yes.”

Your Direct Lender and Super Broker for Optimal Non-Resident Mortgage Options

In the world of foreign national loans and U.S. expat mortgages, having choices is key to landing the best deal. As a leader in non-resident U.S. home loans, America Mortgages operates as both a direct lender and a super broker, giving you unmatched flexibility, affordability and transparency.

What does that mean for you? More loan programs to choose from, competitive pricing that beats the market, lower closing costs, and closings that actually happen on time — without the headaches. Unlike some competitors who may have a narrower scope, we partner with over 85 U.S. banks and lenders to curate the perfect fit for your needs, whether it’s a purchase, refinance, asset based bridge loan or investment property loan.

This hybrid model ensures you’re not locked into limited options; instead, you get the cream of the crop for foreign national mortgage rates and terms. We’ve streamlined the process for expats and international investors, handling everything from documentation in multiple languages to coordinating with global real estate agents. The result? Clients who save time, money, and stress while building their U.S. property portfolio.

Serving Global Clients from Over 57 Countries

Our reach is truly worldwide, and that’s no accident. We’ve successfully closed U.S. mortgage loans for international investors hailing from 57 different countries, spanning Europe, Asia, Latin America, and beyond.

This isn’t just a side service for us; helping foreign nationals and U.S. expats secure financing for U.S. properties is our core mission. Picture this: a tech entrepreneur from Hong Kong buying an apartment in New York, or a retiree from Canada refinancing a condo in Arizona. We’ve made it happen time and again.

In a market where some lenders might offer similar products, our global perspective gives us an edge. Not only do we have U.S. Loan Specialists based around the world working in your time zone and language, we understand cultural nuances, currency fluctuations, and international tax implications that can make or break a deal. If you’re a non-U.S. resident dreaming of buying one property in America or building a real estate portfolio, join the thousands who’ve trusted us to make it a reality.

Exclusively Focused on Foreign National and U.S. Expat Loans

In an industry full of generalists, we stand out by doing one thing and doing it better than anyone else: funding foreign national and U.S. expat mortgage loans. Last year alone, we closed over $480 million in these specialized loans, proving our commitment and capability.

That’s not pocket change, it’s a testament to our efficiency, our network, and our passion for helping non-residents invest in the U.S. housing market. While other brokers, lenders or banks handle a mix of services, our singular focus means every resource we have is poured into perfecting non-resident U.S. mortgages. No distractions, no compromises — just results.

Whether you’re comparing us to any other player in the foreign national space, our numbers speak volumes.

Ready to be part of that success story? Reach out today, and let’s get your U.S. property journey started on the right foot.

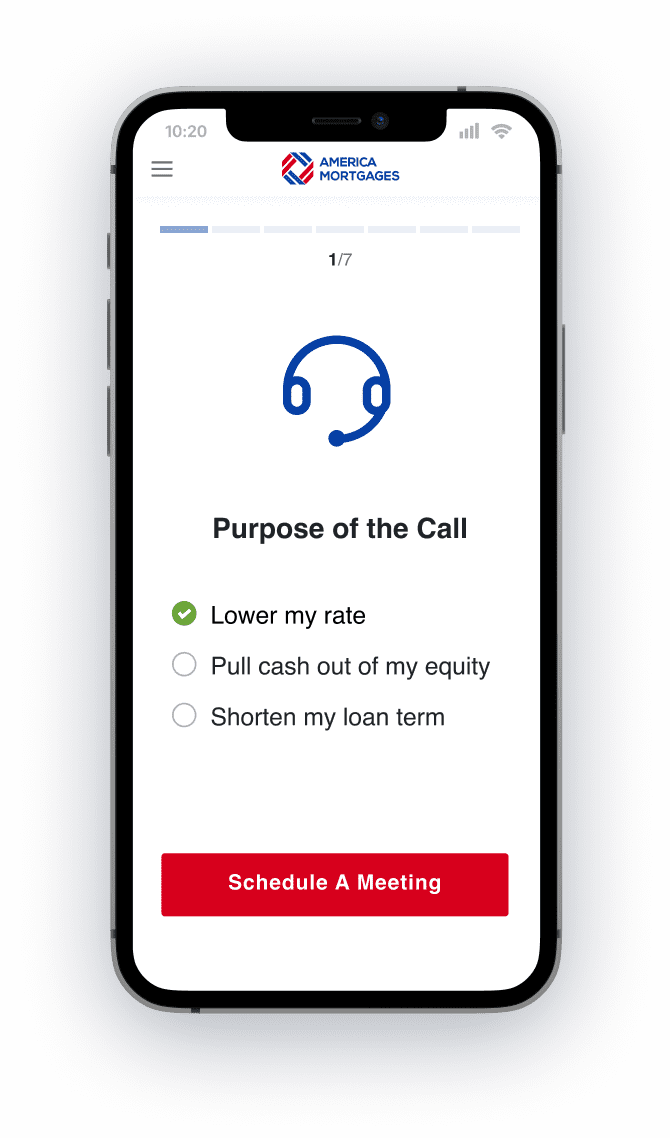

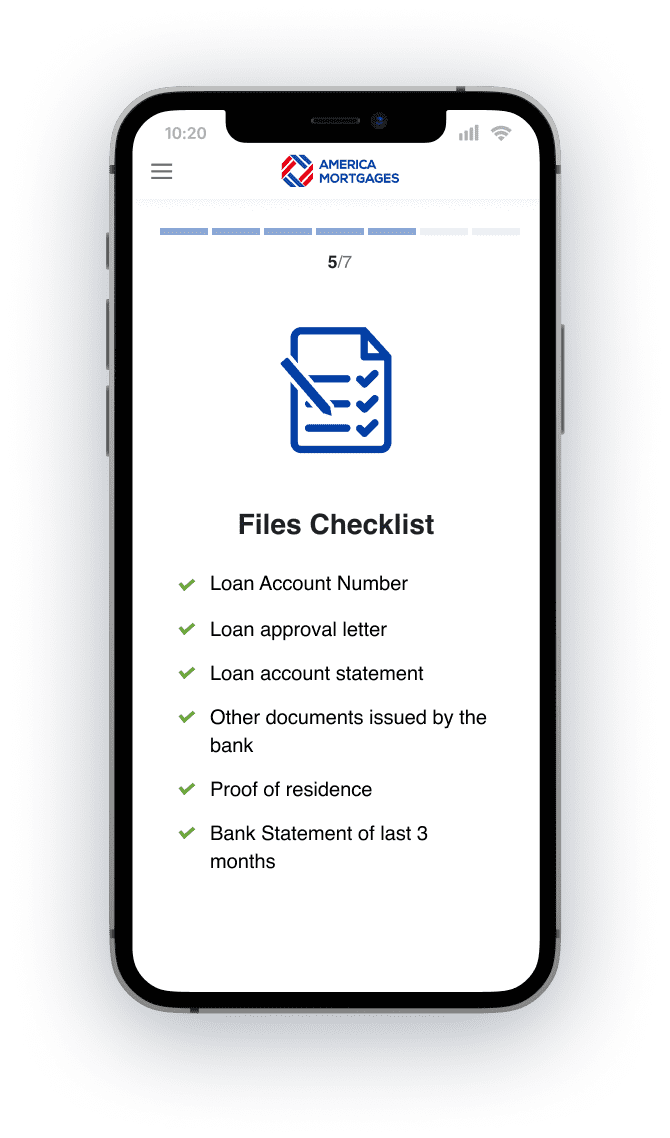

Our simple process

We have eliminated many unnecessary steps to create a simple and easy process for our clients.

-

Speak to our U.S. Mortgage Specialist

Our Loan Officers will understand your requirements and introduce our loan programs.

-

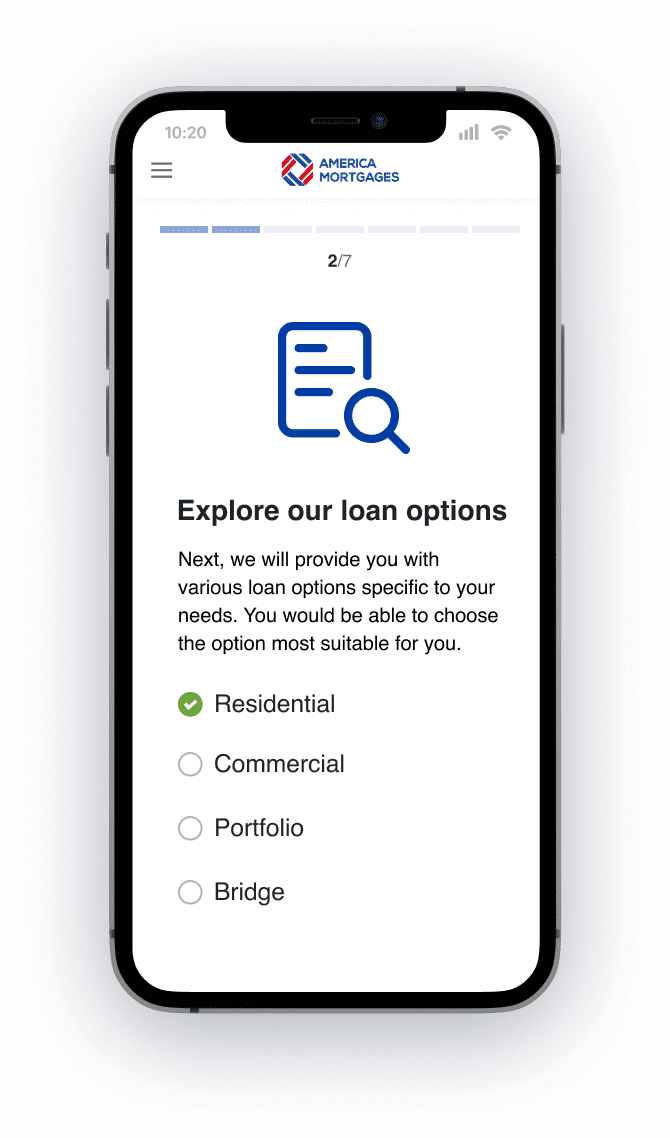

Explore our loan options

After your initial call, we will provide you with various loan options specific to your needs.

-

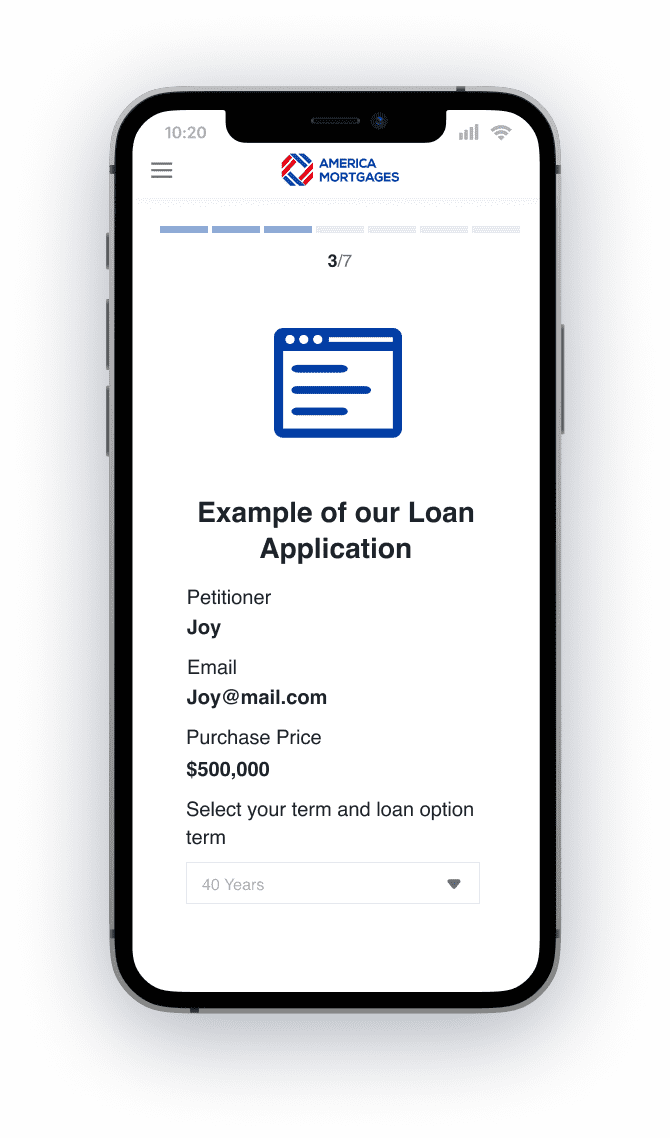

Complete application

We have developed a process that is easy and have eliminated many unnecessary steps. We are here to help.

-

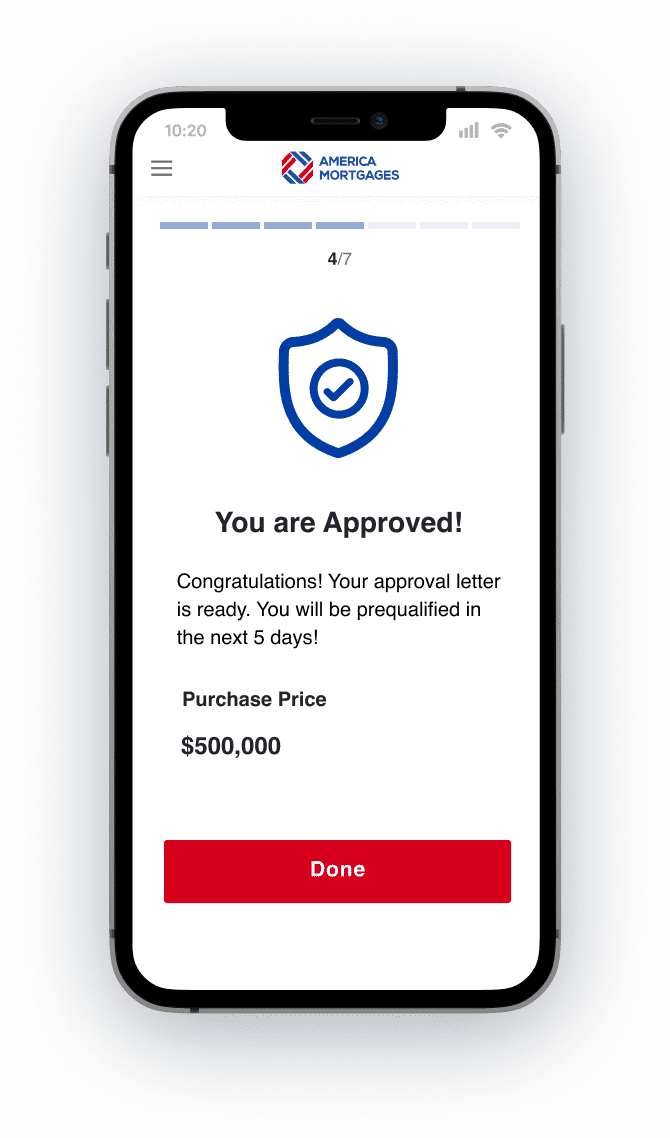

Get loan-approval

Once the application is submitted to the lender, a

Pre-approval will be issued within 5 days. -

Clear Conditions

Our Loan Officer will work with you to gather the remaining documents required by underwriting.

-

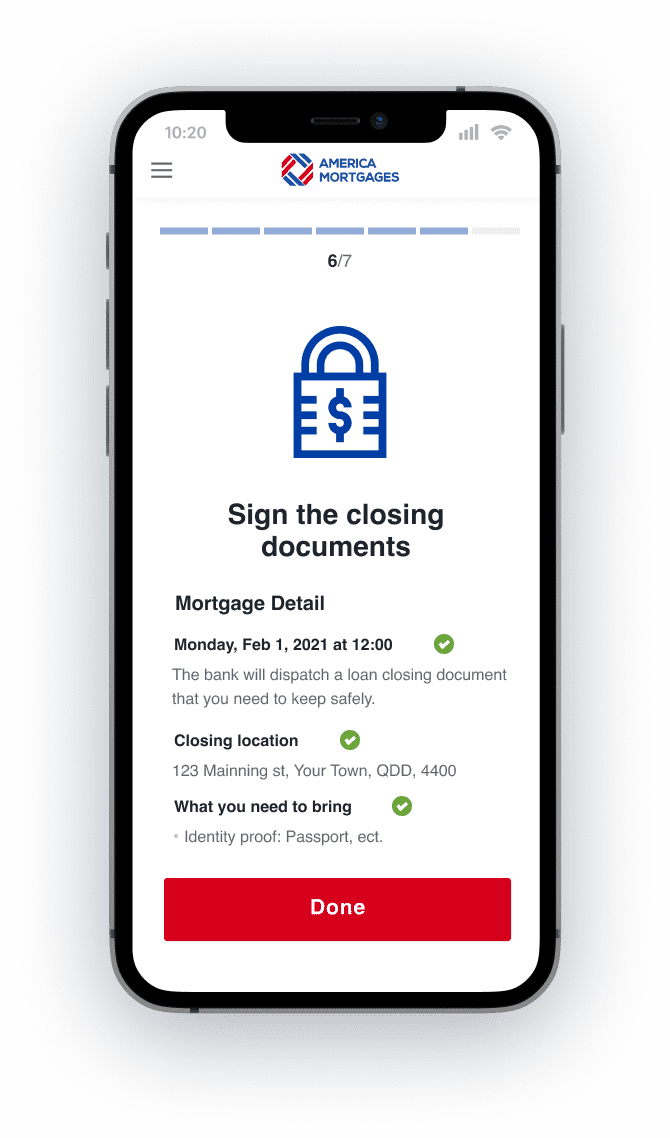

Signing the documents

Sign the closing documents at your local embassy and within a few days your loan will be funded!

-

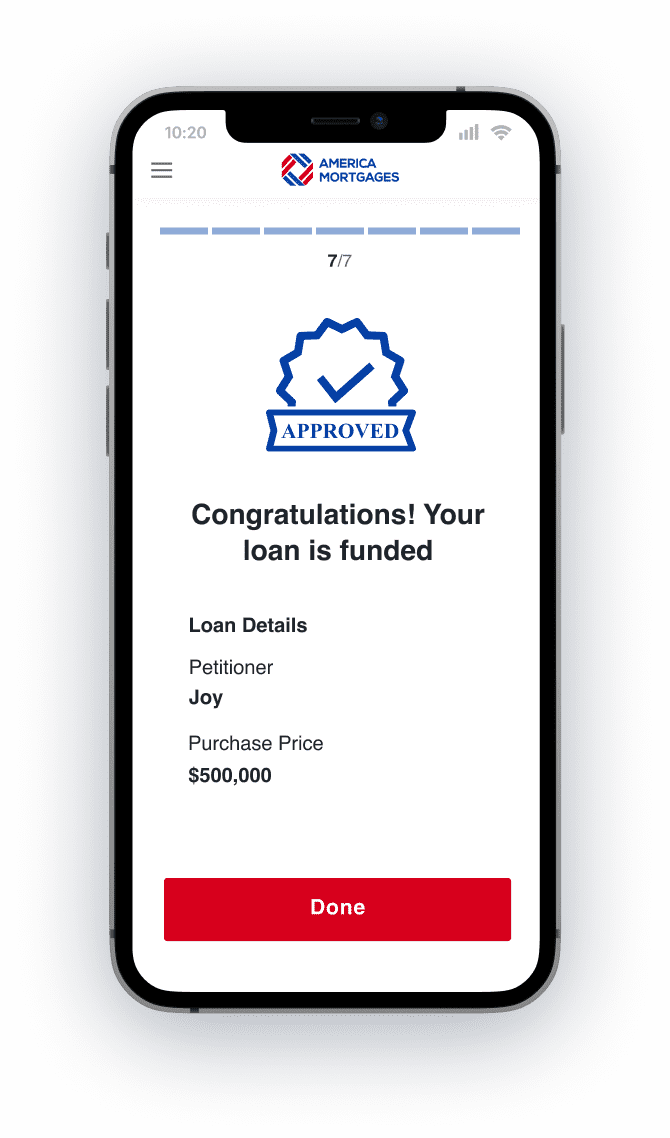

Congratulations – Your loan is funded!

You have now used a mortgage to maximize your cash-flow.

Loan Programs We Offer

Investment Loans (Foreign Nationals & U.S. Expats)

- DSCR Loans – Qualify using rental income, not personal income. Up to 80% LTV, no U.S. credit needed.

- Negative Cashflow Flex – Approvals even if the property doesn’t cash-flow (DSCR < 1.0). Perfect for renovations or growth markets.

- Pure Investment Property Loans – Tailored for rentals, multifamily, or commercial properties. Loan sizes up to $3M.

Second Home Loans (Foreign Nationals & U.S. Expats)

- Finance vacation homes, family residences, or student housing in the U.S.

- Up to 80% LTV for U.S. expats | 75% for foreign nationals.

- Overseas income and assets accepted, no U.S. tax returns required.

Wealth & Asset-Based Loans (High-Net-Worth & Retirees)

- Asset Depletion Loans – Use savings, investments, or retirement accounts instead of income.

- Cash-Out Refinance – Tap into your U.S. property equity for investments, business, or personal needs.

- Equity Release – Unlock property value without selling. Flexible terms up to 30 years.

Specialty Programs (Global Investors)

- Bridge Loans – Close in as little as 2 weeks, up to 70% LTV, asset-based qualification.

- Portfolio Loans – Finance multiple U.S. properties with one simple loan.

- Commercial Loans – For multifamily, office, mixed-use, and retail investments. Accepts foreign income & global assets.

Additional Programs

- No-income loans for self-employed borrowers.

- Tailored HNW programs without asset-under-management requirements.

Why Choose Us?

- 97% approval rate | $480M funded last year | Clients in 57 countries

- 100% dedicated to foreign nationals & U.S. expats

- No U.S. credit, tax returns, or residency required

- Direct lender + super broker model (150+ U.S. banks & programs)

- Multilingual support | Seamless closings in all 50 states

America Mortgages’ Reviews

Concierge Services We Offer

America Mortgages’ Concierge Service is committed to helping international and expat real estate investors achieve their goals in maximizing their U.S. real estate returns. To assist in this effort, we have teamed up with vetted key players in U.S. insurance, tax advisory, money transfer, and wealth management.

As seen in

Schedule a call with our U.S. Mortgage Specialist.

Foreign National and U.S. Expat Mortgage Blogs

Learn how to qualify for a U.S. mortgage loan as a non-U.S. resident through case studies, articles, and useful blogs