Has your property appreciated in value since you purchased it? If so, your equity — the portion of the property you own has increased as well!

A practical way to tap into this growing equity without selling your home is through a conventional cash-out refinance mortgage or an asset-based bridge loan.

Quick Comparison

Bridging loan

- Short term – 1-2 years.

- Qualify on property value only

- Speed a priority – funding times as fast as 1-2 weeks

Cash-out refinance

- Exactly the same as a conventional 30-year fixed-rate mortgage

- Qualify using your salary or rental income of the property

- 30-45 days funding times.

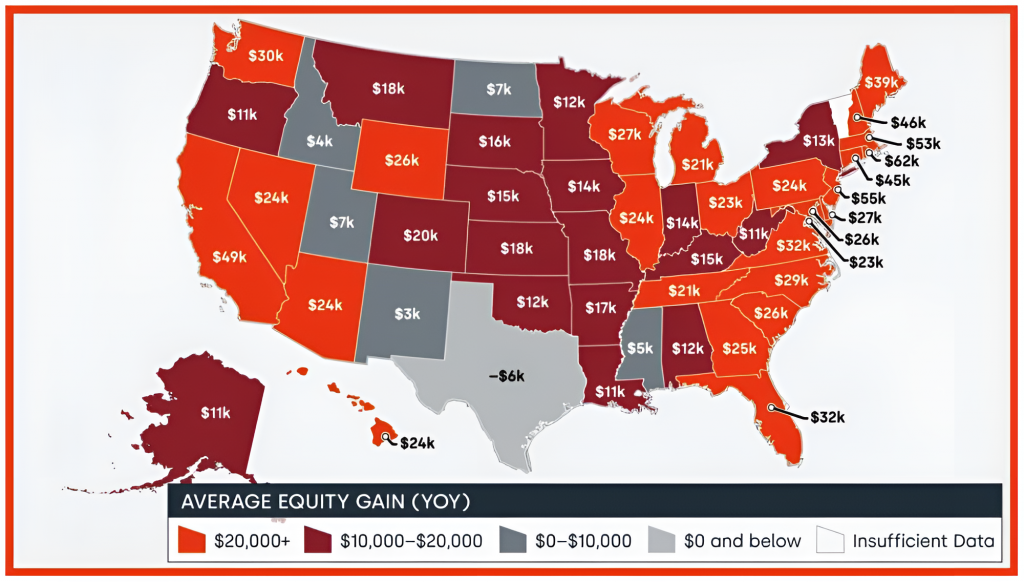

$17 trillion in home equity!

In Q1 2024, CoreLogic reported that U.S. mortgage holders collectively held over $17 trillion in home equity, nearing the previous record set in 2023. With home values rising and equity growing, many homeowners now have significant capital appreciation. America Mortgages has loan programs designed for foreign nationals and U.S. expats looking to use their existing equity for short-term needs or long-term investment opportunities.

Two Ways to Access Your Home Equity

Foreign nationals and U.S. expats often face unique challenges when leveraging home equity in the U.S. America Mortgages’s loan programs are designed to meet these needs, making the process smoother and more accessible.

1. Conventional Cash-out Refinance Mortgages

Cash-out refinance mortgages are a good option if you have consistently made regular mortgage payments in a timely manner since owning the property or if you have no existing mortgage on the property. However, we recognize that securing a mortgage can be challenging for foreign nationals and often U.S. expats because they lack a U.S. credit history. At America Mortgages, we can use international credit reports and other financial documents in lieu of U.S. credit. It’s so straightforward that Foreign nationals are eligible to borrow up to 75% of their property’s appraised value, while U.S. expats can borrow up to 80%.

Key Loan Features and Requirements

- Income: Foreign income accepted

- Credit: No U.S. credit is required

- Term Lengths: 30-year and 40-year fixed-rate mortgages regardless of the borrower’s age

- Term Options: Fixed 10-year, Interest-Servicing Only (Interest-Only) mortgages available

- Loan Amounts: From US$100,000

- Cash-out Refinance Loan-to-Value (LTV): Up to 80% for a U.S. expat and 70% for a Foreign National

- Property Types: Single-family, multi-family (5+ units), duplexes, triplexes, quadplexes, condominiums, townhomes, commercial, industrial

- Location: All 50 U.S. States

- Amortization: All loans can be amortized over 30 years, regardless of age

- Closing Time: 30-45 days

2. Asset-backed real estate bridge loans

Asset-backed bridge loans are designed for U.S. expats and foreign nationals who need flexibility and quick access to funds. These loans are perfect for short-term financial needs or investment opportunities and normally do not require the borrower to provide financials.

Key Loan Features and Requirements

- Income: No income required

- Credit: No U.S. credit is required

- Eligible Loan Types: Purchase, refinance, and cash-out refinance

- Term Lengths: 12-24 months

- Loan Amounts: US$200,000 to US$100m

- Payment Options: Monthly, interest-only, interest rolled up

- Loan-to-Value (LTV): Up to 75%

- Property Types: Single-family, multi-family (5+ units), duplexes, triplexes, quadplexes, condominiums, townhomes, commercial, industrial

- Location: All 50 U.S. States

- Amortization: Interest-Only Servicing

- Closing Time: 3-10 days

Global Bridging Loans

For investors looking to release equity from their property globally, our parent company, Global Mortgage Group, offers bridge financing in Canada, U.K., Europe, Australia, Dubai, Singapore, Hong Kong, Philippines, and Thailand.

Bridging loans are short-term loans, usually 1-2 years, used to bridge a funding gap where banks cannot meet borrower requirements such as speed of funding, loan-to-value, and certainty. These loans are asset-backed, relying on the collateral value of the property rather than the borrower’s personal financials. They typically feature “interest-only” or “interest-servicing only” payments with a bullet repayment at the end of the term. Bridging loans have become popular as retail banks globally reduce their lending on property, with private credit filling the gap.

Basic Details:

- Get approved in 48 hours and funding in as fast as 7 days

- Up to 70% of your home’s value

- Available for primary homes, second homes, and investment properties

- Priority is speed of funding, certainty, and high loan-to-value

- Short-term and not meant to replace a bank loan

- No age restriction in many countries

America Mortgages and Global Mortgage Group aims to simplify the process for foreign nationals and U.S. expats, providing the financial flexibility they need. Our tailored loan programs are designed to suit your unique situations, helping you make the most of your property’s equity.

With our fast approval process, flexible terms, and international reach, we’re here to support your financial needs. Schedule a meeting with one of our loan officers using our 24/7 calendar link and let’s turn your home equity into cash for whatever you need. Get started now!