With the recent addition of two new America Mortgages’ Non-Resident mortgage programs, a reduction in current interest rates, and owner-occupied borrowers still sitting on the side-lines, 2024 is poised to be the best year for U.S. real estate investing. According to Fitch Ratings, home prices are expected to rise by at least 2-4% in 2024. The anticipated 75 basis points interest rate cut by the Federal Reserve in 2024 is poised to boost the real estate market, creating an opportunity to buy now before the craziness begins.

As we enter 2024, the U.S. real estate market is undergoing a notable shift, echoing sentiments consistently emphasized by America Mortgages in recent months. Redfin’s Senior Economist Elijah de la Campa observes, “Mortgage rates are coming down, more people are listing homes for sale, and there are still plenty of side-lined buyers ready to take advantage of fresh inventory.” The expected drop in mortgage rates and an increase in housing inventory present compelling opportunities for investors, reinforcing the optimistic outlook for the real estate market in 2024.

As a company, we love to quote successful real estate investor Barbara Corcoran. In a recent article in Yahoo Finance, Barbara predicts “housing prices are going to go through the roof.” She goes on to state, “The minute those interest rates come down, all hell’s going to break loose, and the prices are going to go through the roof,” she said. “[Right now sellers are] staying put. But they’re not going to stay put if interest rates go down by two points. “It’s going to be a signal for everybody to come back out and buy like crazy, and the house prices [will likely] go up by 20%,” she said. “We could have COVID [market] all over again.”

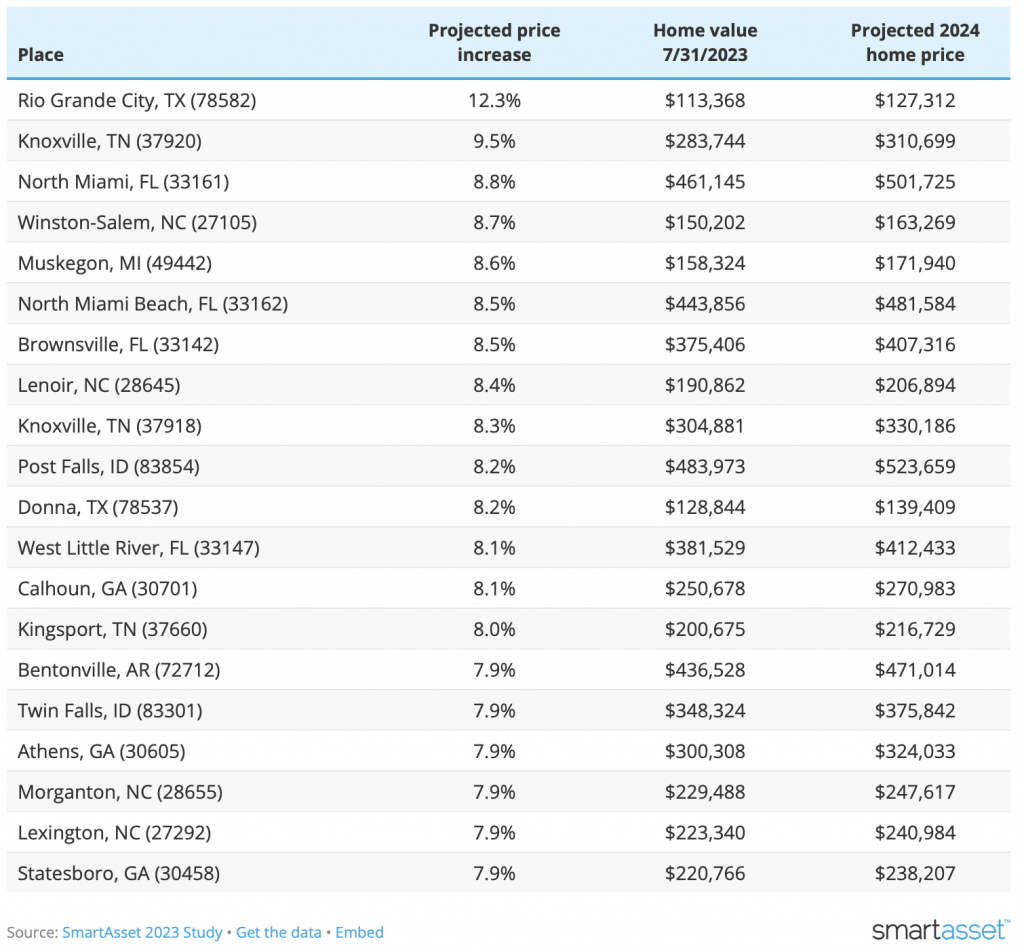

Zillow recently ranked 2,000 zip codes by the highest projected home price increases.

The key findings:

• Miami and Knoxville homes have the most promise. While Rio Grande City, TX (78582) has the highest projected home value increase at 12.3%, Knoxville and Miami neighborhoods claim four of the top 10 spots. In Knoxville, home values may grow by 9.5% in the 37920 neighborhood and 8.3% in the 37918 neighborhood. Home values in the 33161 neighborhood in North Miami are projected to grow 8.8% by summer 2024 and by 8.5% in the 33162 neighborhood of North Miami Beach.

• About 80% of the top 50 projected home price increases are in the South. This includes Winston-Salem, NC (27105, 8.7%; 27107, 7.3%); Athens, GA (30605, 7.9%; 30606, 7.7%); Myrtle Beach, SC (29588, 7.8%); Savannah, GA (31419, 7.8%); and Charlotte, NC (28208, 7.5%).

• These NYC neighborhoods are projected to grow by 7% or more by next summer. Fort George (10040), Jamaica (11434), and Washington Heights (10032) are poised to have the highest growing home values in all of New York City.

• These neighborhoods have the highest projected home value growth in these major cities. In Chicago, the 60623 neighborhood is projected to see home values grow 4.9% by next summer. In Phoenix, the 85009 area is projected to see a home value growth of 6.9% by the same time next year. But, in San Francisco, the 94121 area is projected to see 1.7% growth. Some of the lowest home value growth projections are in San Francisco.

• Home prices are projected to grow by $100,000 in this San Diego neighborhood. In Carmel Valley – 92130 – the projected 5.3% growth on the current $1.85 million home value would lead to a $98,382 average price increase. Other CA places with the largest price increases include 90275 in Rancho Palos Verdes ($92,403), 92024 in Encinitas ($80,541), 92705 in North Tustin ($77,510), and 93117 in Goleta ($75,213).

Projected Home Value Increases by Summer 2024

According to Zillow, cities are listed in order of the highest projected home value increases between July 31, 2023, and July 31, 2024.

As your partner in real estate, America Mortgages is committed to guiding you through these opportunities. 100% of our clients are non-U.S. residents buying or refinancing U.S. real estate. This is all that we do, and no one does it better.

With up to 75% LTV in all 50 U.S. states for a Foreign National and 80% for a U.S. expat, America Mortgages is your “go-to” source for reliable, flexible, market rate U.S. mortgage loans.

If you have any specific inquiries or require personalized guidance, our dedicated team at America Mortgages is ready to assist you throughout your real estate investment journey. Contact us at [email protected]. If you wish to arrange a commitment-free meeting with one of our U.S. loan officers to explore U.S. mortgage options, here’s our 24/7 calendar link. Wishing you a year filled with thrilling opportunities and prosperous ventures in the ever-evolving U.S. real estate market!