[Super rare] Newly-constructed multi-family unit in Los Angeles with a 6.8% cap rate!

4 Units x 5 bedrooms + 5 bathrooms + attached garage (total 20 bedrooms!). Approximate Lot Size: 7,499 sq. ft. Year Built: 2024

The property will be delivered with a 5-year master lease with government-assisted transitional housing organization.

Located just 0.2 miles from the University of Southern California’s Health Sciences Campus and offers easy commutes to Downtown Los Angeles, Mid-City, and the Westside.

The 2024 construction ensures no deferred maintenance and strong in-place income. The property will be delivered fully occupied through 2024-2029, providing investors with immediate stabilized cash flow greater than 6.8% cap rate on current income.

Projected Monthly Rent: Y1 $23,000; Y2 $23,690; Y3 $24,400; Y4 $25,132; Y5 $25,886

Contact me directly for pricing and financing options.

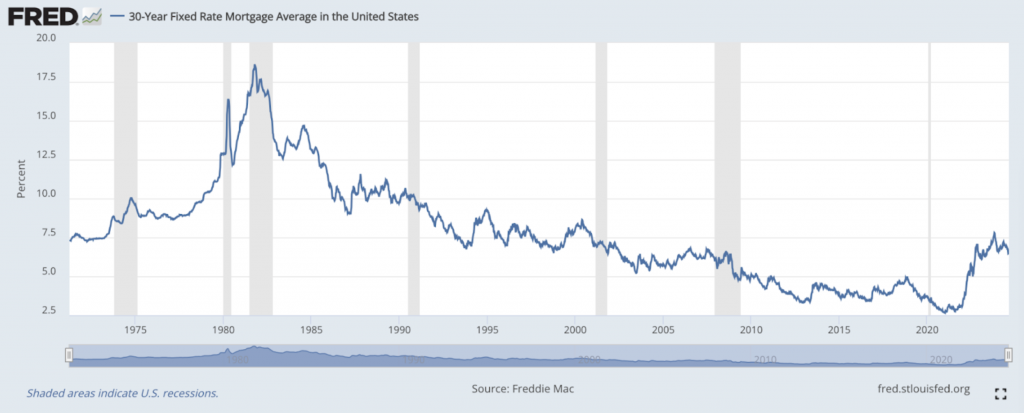

A unique opportunity is emerging for U.S. expats and foreign national investors: the potential for a U.S. interest rate cut, which could lead to an immediate rise in real estate values. Recent comments from Federal Reserve Chairman Jerome Powell suggest that lower rates are imminent, which could create a huge opportunity for our clients to act.

What U.S. Expat and Foreign National Investors Should Expect

Markets and financial analysts are firmly expecting the Federal Reserve to cut interest rates at its upcoming meeting on September 18. This expectation is grounded in recent signals from the Fed, including comments from Jerome Powell at the Jackson Hole Economic Symposium, where he hinted that the time has come for policy adjustments.

As we’ve always said, if U.S. interest rates decrease, property prices will increase. Lower rates typically result in increased market activity, with more domestic and international buyers eager to secure properties at lower financing costs. For U.S. expats and foreign nationals, this could mean a potential increase in competition for U.S. real estate, which may drive up property prices.

30-Year Fixed Rate Mortgage Average in the United States

However, this also presents a strategic advantage for overseas investors. By acting before rates drop further and competition intensifies, investors can purchase a property before market demand pushes prices higher.

The Golden Opportunity

The possibility of a U.S. interest rate cut presents a golden opportunity for savvy investors. With the potential for lower borrowing costs and a more competitive market, acting now could position you ahead of the curve, allowing you to secure U.S. properties at favorable prices before the market shifts.

Why Now is the Time to Act

At America Mortgages, we understand the unique needs of U.S. expats and foreign national investors. We believe that this moment calls for decisive action. Waiting for rates to decrease further might mean missing out on prime U.S. properties at today’s prices. With the market poised for a possible surge in activity, those who move quickly — will likely benefit from more favorable purchasing conditions.

AM Investor +

- Property Type: 1-4 units (one property)

- Minimum Loan Amount: US$150,000

- Loan-to-Value: Up to 75% for purchase & 70% for cash-out

- Underwriting: Based on an income letter, not personal tax returns

- Credit Requirements: No U.S. credit required

- Tax Requirements: No tax returns required

- Closing Time: 30-45 days

These offerings are designed to simplify the process and make U.S. real estate investment more accessible and rewarding for U.S. expats and foreign national investors.

Position Yourself for Success

We believe that by acting now, you can position yourself ahead of the curve, securing a property before the market shifts and competition intensifies. It’s still a buyer’s market, however, how long that will last is uncertain.

America Mortgages is committed to providing the best loan solutions and expert guidance to help U.S. expats and foreign national investors navigate this potential turning point in the U.S. real estate market. With our enhanced loan programs, investors have the tools they need to make smart investment decisions.

If you would like to discuss your loan options, schedule a call with one of our U.S. Loan Specialists 24 hours a day, 7 days a week. If you’d like to speak with someone right away, please call us at +1 (845) 583-0830.

Don’t miss out on what could be a significant moment for your investment portfolio. Contact us today to explore how we can help you take advantage of this unique opportunity.